10 reasons your work must offer Salary Sacrifice on EVs

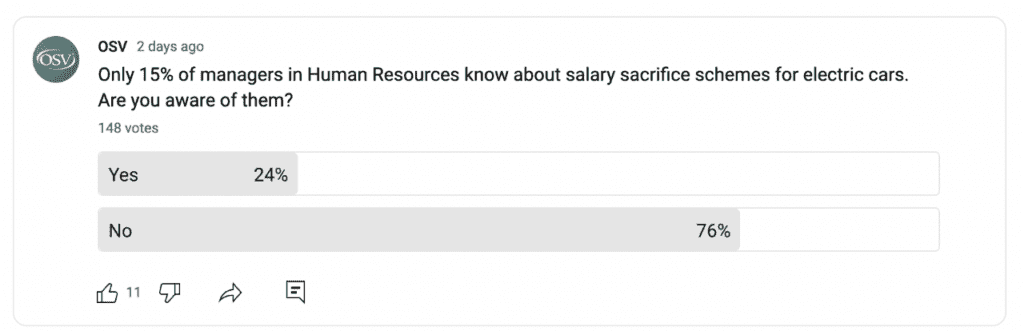

Did you know that just 15% of managers in Human Resources departments are aware of salary sacrifice schemes for cars, especially electric?

OSV took to its YouTube following of 78.6K and ran a poll asking if they were aware of salary sacrifice schemes on electric cars. Here are the results:

Not too far from the original findings, a whopping 76% were not aware of salary sacrifice schemes for electric cars.

Considering the vast benefits up for grabs for both employers and employees, it’s a real shame only 24% are aware of these.

So, why should your workplace care about salary sacrifice schemes for electric cars?

1. Employee appreciation

How does this benefit the employee?

Being appreciated at work is always welcome, and whilst employees may be appreciated by their employers – they may not think or feel it.

Offering an opportunity to get a car that perhaps employees couldn’t afford otherwise, as well as a bundle of financial benefits is a great way to ensure employees feel taken care of.

Why should the employer care?

Appreciation goes a long way. As some say, what goes around comes around.

An employee who feels valued and respected as a person is much more likely to return the favour.

Companies that fail to appreciate their employees risk facing demotivation among staff.

A whopping 43% of employees are demotivated due to feeling invisible or undervalued.

Which side of the scale do you want to be on?

2. Reduced National Insurance

How does this benefit the employee?

When an employee takes part in a salary sacrifice scheme, they are reducing their salary in return for a benefit, such as childcare support or a new electric car.

As the salary is reduced before tax deductions, the employee pays less national insurance (NI).

How?

Employees pay a percentage of their salary towards NI. This is usually 12% of their earnings.

If, for example, their monthly wage is £2,625. The employee would usually pay £315 NI per month.

When they take part in a salary sacrifice scheme, let’s say it reduces their monthly wage by £300, they would then only pay £279 of NI per month.

Why should the employer care?

Employers also get to enjoy NI reductions. As many may already know, employers pay 13% of NI contributions for each employee.

As explained previously, if the employee’s salary is reduced so are their NI contributions. This applies also to the amount the employer pays too.

So, both parties get to enjoy money-saving benefits!

3. Reduced tax

How does this benefit the employee?

On top of reduced NI contributions, employees also pay less tax.

How does this work?

The concept is exact to the NI contribution reductions we explained earlier.

Let’s revisit the monthly wage of £2,625. When taking part in a salary sacrifice scheme which sacrifices £300 of their monthly wage, this would mean just 20% would be taxed at £2,325 instead of £2,625.

That’s a £60 reduction in tax the employee has to pay.

Remember this: the larger the sacrifice of salary, the less tax and NI contributions employees pay.

Why should the employer care?

They are actively demonstrating a way their employees can save on tax and in return save money on what is likely to be their second most expensive cost as private individuals.

In return, the employees are likely to show more loyalty and respect for their employer.

4. Reduced company car tax

How does this benefit the employee?

Employees who finance their electric cars through a salary sacrifice scheme, although they do enjoy tax reductions, they do have to pay company car tax – as it is the property of the company they work for.

Luckily enough, the company car tax is incredibly low for electric cars.

Tax on company cars can shoot right up to 37% of the car’s RRP. Electric car drivers pay just a 2% Benefit-In-Kind (BIK) rate as of the tax year 2023/2024.

Let’s say the RRP of an electric and diesel car are both £30,000.

The diesel version returns a 37% BIK rate, so that’s £11,100 to pay per year.

The electric model returns a 2% BIK rate, which is just a mere £600 per year!

Why should the employer care?

Employers who take care of their employees, ensuring they are better off financially, are less likely to experience high employee turnover.

5. Reducing carbon footprint on roads

How does this benefit the employee?

They are taking a proactive personal step in reducing their CO² emissions on the roads. On top of this, the way the UK is moving towards phasing out non-electric vehicles, they will ultimately have a vehicle that will soon have more support than internal combustion engine (ICE) cars.

Why should the employer care?

Studies show people who take a step towards engaging in environmental values and taking action have improved overall well-being and mental health.

So, not only do employees feel good about reducing their overall CO² emissions on the roads, but it could also have a positive effect on their day-to-day mental well-being. Which in turn, by default, will be reflected in their work and role.

6. Exemption from ULEZ & Congestion charges

How does this benefit the employee?

City congestion areas including Clean Air Zones and Ultra Low Emission Zones are slowly expanding in large UK cities.

It is likely in the future that one of these areas will be planted near you or near your daily commute.

Those who are exempt from these areas avoid paying daily charges of up to £15 per day.

What does this mean for employees? Electric drivers can save up to £5,475 a year!

Why should the employer care?

Ensuring employees benefit from as many financial advantages is a great way to guarantee employee retention and loyalty.

A workplace that not only offers a fantastic scheme to get an electric car for less but also has their employee’s personal finances in mind is quite a rare quality to have and is a definite way to keep loyal employees.

7. Employee loyalty

How does this benefit the employee?

If the employee feels taken care of and seen as a person with individual needs rather than just a number in the great big system, they are much more likely to stick around.

Loyalty works both ways. If an employee is expected to commit years of their life to a company, the favour should be returned.

This is why salary sacrifice on electric cars is so popular. Not only do employees gain exciting benefits, but they feel trusted by their employer. Enough so for them to offer 2-, 3- or 4-year leases on a brand-new electric car!

Why should the employer care?

Training new staff costs – a lot.

Not only do you have to spend time and resources to teach skills and familiarise starters with the methods of the company, but you also have to spend a lot of money doing this.

The average cost of replacing an employee is nearly £30,000. What about replacing 3 employees? You’re looking at around £90,000.

So, the most beneficial thing you can do is retain existing employees, and ensure you do so by nurturing them as individuals, not numbers.

8. New car for less

How does this benefit the employee?

If we consider that salary sacrifice schemes for electric cars promise reduced tax and NI contributions, exemptions from city congestion zones, AND a reduced price for the new electric car – it seems silly to question how this is beneficial for employees.

Why should the employer care?

A workplace that offers a brand-new electric car to employees, that they perhaps otherwise could not afford, is a great way to stand out from the crowd against other recruiters.

This is also a fantastic incentive to retain existing employees.

9. Early termination insurance

Life happens, things change – we understand. That’s why OSV offers Early Termination Insurance (ETI) should anything change or happen to employees.

What exactly does this cover?

- Resignation

- Long-term sickness absence

- Accidental death

- Maternity

- Adoption and Paternity

- Loss of licence on medical grounds

This is hugely beneficial for both parties.

10. No credit check

How does this benefit the employee?

Life happens, not everyone is perfect. Not everyone will have been on top of their finances from day 1.

Employees who are excellent with paying their bills on time may have learnt to do so because they weren’t so great at it to start with.

The great thing about a salary sacrifice scheme on EVs and all cars is that there is no credit check done on employees.

This ensures each and every employee has a fair chance of applying to the scheme, with no judgement of their past.

Why should the employer care?

Along with employee retention, this will further boost employees feeling valued.

A boss that truly understands that everyone struggles sometimes, sees that and still offers a salary sacrifice benefit.

This decision of giving someone a chance, someone who struggled with payments long ago, may seem small to the employer, but for the employee?

It could be the confidence boost they needed just to feel better, which in turn is likely to benefit those around them in their personal life and at work.

It should be said that the company will have a credit check, and will need to demonstrate affordability. But for the cost of staff feeling valued and increasing employee retention, it is well worth it.

Should your workplace offer salary sacrifice schemes for EVs?

So, should your workplace offer salary sacrifice schemes for electric cars? Is it worth the time, money and effort?

Sometimes you need to spend money to make money.

Is it better to invest in nurturing new and existing employees and reduce the chance of losing up to £90,000?

Or should businesses prioritise saving as much money as possible, whilst potentially neglecting their employees?

We’ll leave that for you to ponder…

Fed up with looking for your next vehicle?

Need advice from an experienced Vehicle Specialist on what vehicle is right for you?

Book your FREE consultation now