OSV

The UK's Trusted Leader in Car Leasing and Sales

Best salary sacrifice company for EVs: top 5

- Why should I use a salary sacrifice company?

- What should you consider when using some salary sacrifice companies?

- Should I use a salary sacrifice company?

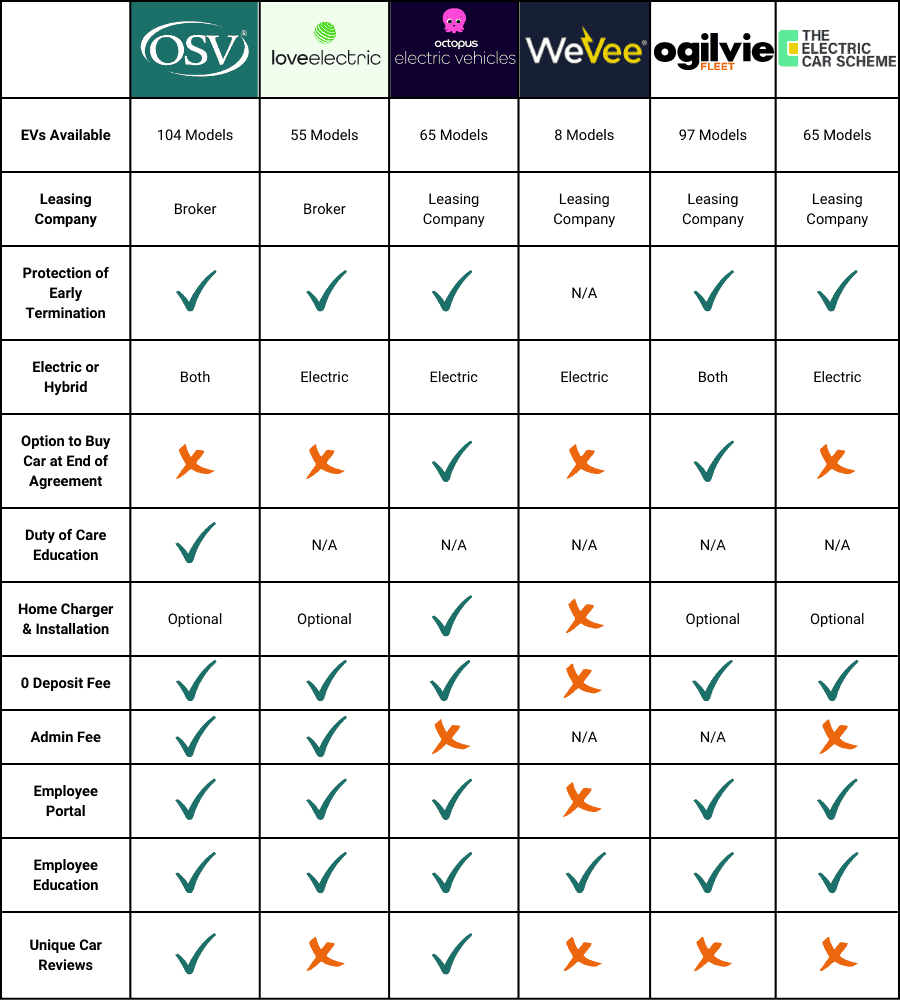

Looking to source new electric vehicles for your employees on a salary sacrifice scheme? Need to know the best salary sacrifice company that’s most suited to your business? You are in the right place.

Salary sacrifice car schemes have proven to provide a bundle of benefits for employers and employees alike, including – improved employee retention, engagement and loyalty and great money-saving benefits for everyone. Win-win! 2

What are the best 5 EV salary sacrifice companies in the UK?

- OSV – Founded in 1997 OSV provides over 100 years of combined experience in the motor industry, vehicle leasing, financing and purchasing. So, you’re in the hands of experts who really know their stuff. Enjoy access to the whole electric vehicle market with no deposit, an EV charger and installation and an EV care package (including insurance, breakdown cover, servicing, tyre repairs and maintenance).

- WeVee – Established in 2017 with the goal to accelerate moving forward into a more sustainable automotive future, the company offers a selection of 8 EVs via salary sacrifice along with a personalised presentation of how their salary sacrifice scheme benefits your company specifically. WeVee hopes to make EVs more accessible for all UK motorists.

- Ogilvie Fleet – An award-winning business contract hire & leasing company which has been going since 1993, Ogilvie Fleet provides a range of EVs, with an insurance and maintenance package included, and the option to add a home charger in the monthly payments. The company aims to assist businesses across the UK to reach their green goals and reduce the environmental impact of their fleet vehicles.

- The Electric Car Scheme – Founded in 2018, the company specialises in electric vehicles and offers a selection of 65 EVs with no deposit upfront, protection of early termination should the employee leave and the option to add an EV home charger with installation. The Electric Car Scheme is committed to helping individuals and businesses move towards a greener future in vehicles.

- Octopus EV – What started as an electric energy provider evolved into a UK-based renewable energy and EV specialist company founded in 2018. Customers have a selection of electric vehicles to choose from with insurance, maintenance included and an EV home charger. Employees have the option to purchase the vehicle at the end should they wish to.

When selecting your salary sacrifice company, it’s important to first understand your individual needs and requirements as a business, but also which company is going to provide the support your employees need.

After all, they are the ones who will be most impacted by the company you decide to use.

So, we would advise also thoroughly considering the needs of your staff when choosing the best EV salary sacrifice company for you.

Why should I use a salary sacrifice company?

So, why should anyone use a salary sacrifice company? Well, this depends on the person and their individual needs.

Often, employers set up this car scheme to provide an attractive employee benefit for existing staff and recruit new talent.

EV salary sacrifice has proven time and time again to bring fantastic benefits to businesses such as improving employee retention, loyalty and engagement, whilst also attracting the best talent in a competitive recruitment market.

In addition to this, working with an EV salary sacrifice company can offer other benefits including:

- Tax savings: employees can save up to 40% on a car salary sacrifice scheme, and enjoy exemptions from congestion charges and low Benefit-In-Kind rates on EVs. Employers save on paying less National Insurance contributions for each employee on the scheme.

- Competitive rates: EV salary sacrifice companies usually offer competitive rates on new cars, which means they can find you the most affordable vehicle fleet solution.

- Maintenance & insurance included: some EV salary sacrifice companies provide an optional all-in-one EV package including maintenance, insurance, servicing, tyre repairs and a home charger with installation.

- A new car every few years: Most EV salary sacrifice companies will offer the option to upgrade a vehicle once the contract has finished. This means a chance to enjoy the latest technology and features – with no worries about the car depreciating!

Do these benefits sound worthwhile to your staff and business? Who would say no to saving tax, access to competitive rates on new EVs and the chance to put a smile on your employee’s face?

Whilst car salary sacrifice companies do offer some very attractive benefits, there are some downsides to consider.

What should you consider with using some salary sacrifice companies?

What about some of the things you should consider when using a salary sacrifice company? Are there any downsides to look out for?

Yes, of course with everything in life, there are some disadvantages to be aware of. The question you should ask is, are these disadvantages worth it for your company?

Here are a few things to consider with a salary sacrifice company:

- Early termination fees: if an employee decides to leave the company or salary sacrifice car scheme mid-way, the payments fall onto the employer to cover. OSV offers a solution to this with Early Termination Insurance, get in touch today for more information.

- Pension & mortgage: taking part in a car salary sacrifice scheme could affect an employee’s pension and application for a mortgage.

- Responsibility for upkeep: While some car salary sacrifice companies offer a maintenance and insurance package, others do not.

- No ownership: Usually, car salary sacrifice companies do not provide the option to own the car outright.

Now that we’ve covered the potential risks involved in working with an EV salary sacrifice company, do these downsides outweigh the benefits for your company personally?

We recommend considering both sides of the coin before looking to set up a salary sacrifice scheme for your company.

Should I use a salary sacrifice company?

So, should your business use an EV salary sacrifice company?

If the benefits including; paying less tax and National Insurance contributions; improving employee retention, loyalty and engagement; as well as saving money overall as a company, sounds worth it – then yes it is definitely worth considering contacting an EV salary sacrifice company.

First, we would urge you to evaluate if the risks are worthwhile for your business and staff.

If you already have business goals in place to provide employee benefits and save money for your business, then it is well worth considering setting up a salary sacrifice scheme for your company.

6 Best car salary sacrifice brokers UK

- Why should I use a salary sacrifice broker UK?

- What are the advantages of using a UK salary sacrifice broker?

- What are the disadvantages of using a UK salary sacrifice broker?

- Should I use a UK salary sacrifice broker?

Are you an employer looking to set up an employee benefits scheme to provide them with electric cars? Interested in the top 6 best car salary sacrifice brokers in the UK? You’re in the right place…

Here are the best 6 car salary sacrifice brokers in the UK:

- OSV – Provides over 100 years of combined experience in the motor industry. So, you’re in the hands of experts who really know their stuff. Enjoy access to the whole electric vehicle market with no deposit, an EV charger and installation and an EV care package (including insurance, breakdown cover, servicing, tyre repairs and maintenance).

- Tusker – As a carbon-neutral company Tusker offers a range of electric cars with no deposit and an inclusive package including insurance, breakdown cover and maintenance.

- Zenith – Provides a wide range of EV options, with additional benefits like maintenance, insurance, servicing, breakdown cover, replacement tyres, windscreen & glass cover and accident management.

- Fleet Evolution – Provides drivers with a cost-effective and flexible car leasing solution with no credit checks, and fleet vehicle solutions for employers

- Select Car Leasing – Offers salary sacrifice car schemes for both electric and non-electric cars with a variety of options.

- Loveelectric – Provides many electric vehicles available with no deposit, maintenance included, breakdown cover and the option to add a home charger

Why should I use Salary Sacrifice broker UK?

So, why should I use a UK car salary sacrifice broker? Is it worth it? More often than not, a UK salary sacrifice broker provides a more convenient and cost-effective way to get a brand-new electric car.

What are the advantages of using a UK salary sacrifice broker?

So, what are the advantages of using a UK salary sacrifice broker?

- Cost-effective: electric car salary sacrifice offers low monthly payments, low Benefit-In-Kind (BIK) rates, exemption from congestion charges, and fantastic tax and National Insurance reductions

- Competitive pricing: Unlike many car providers, brokers have access to multiple funders ensuring the most affordable car solution for you

- No upfront costs: Many UK salary sacrifice brokers do not ask for an upfront deposit

- Inclusive care package: Most schemes offer insurance, maintenance, and general servicing included in the monthly payment. Some can offer an optional home electric car charger with installation included

- Access to a wider range of cars: the best UK salary sacrifice brokers will have access to all manufacturers and car dealers – giving you more freedom of choice.

If saving money on tax and NI contributions, paying less BIK rates, easy monthly costs and an inclusive care package sounds like the car salary sacrifice solution that’s up your street – using a UK broker for your salary sacrifice scheme is likely to be ideal for you.

What are the disadvantages of using a UK salary sacrifice broker?

Whilst there are many benefits to using a UK salary sacrifice broker, there are some things to consider as well:

- Tax implications: pension contributions, maternity pay and tax credits can all be affected whilst taking part in a salary sacrifice scheme

- Limited mileage: there is an agreed amount of mileage you are allowed per year, exceeding this can result in fees

- Early termination fees: if the employee leaves the contract the employer may be faced with early termination fees. This can be overcome with Early Termination Insurance offered by OSV

- Credit rating: Car salary sacrifice schemes involve a credit check on the business looking to set it up for their employees. If the check fails, this will impact the company’s credit score.

So, there are a few disadvantages to consider when looking at car salary sacrifice schemes. But there are also a number of benefits that outweigh the potential risks and limitations too.

We advise chatting with a Salary sacrifice specialist for advice on whether or not your company is suitable for setting up a scheme.

Should I use a car salary sacrifice broker in the UK?

So, should you use a UK broker for car salary sacrifice? When choosing your broker, it is vital you first understand your needs, circumstances and wants. Here are a few things to consider:

- Budget: enjoy low fixed monthly payments – making budgeting easy! Remember to ensure taking part in car salary sacrifice doesn’t take you below the minimum wage threshold, and you can still live comfortably after the salary sacrifice deductions.

- Employment status: Self-employed team members are not eligible to take part in the scheme. If you work for a PAYE company and the scheme is offered, it’s worth checking with your employer if you fit the requirements to participate.

- Tax implications: Although there are tax, NI and BIK rate savings in car salary sacrifice, there are other areas that could be affected including pension contributions, maternity pay and tax credits.

- Credit rating: Car salary sacrifice schemes involve a credit check for the company set it up, so it’s worth checking the business’ finances beforehand to ensure it doesn’t get declined – as this will affect the credit score.

Looking for a cost-effective and convenient way to get a brand-new electric car? A salary sacrifice broker is the perfect solution for you.

Remember to consider your individual needs and requirements when choosing your salary sacrifice car solution. Take advantage of Vehicle Specialist advice and ask as many questions as you need, it’s what they’re there for!

Is salary sacrifice worth it for my company in 2023?

- What is salary sacrifice?

- Is salary sacrifice a good idea for my business?

- Will it save my company money?

- When would salary sacrifice not be worth it for your business?

- Is salary sacrifice worth it for my company?

Have you been considering setting up a car salary sacrifice scheme for your company? Does the question “Is salary sacrifice worth it for my company?” pop up often in your mind?

Read on to explore everything you need to know about if salary sacrifice is worth it for your company, and if you should set one up today.

What is salary sacrifice?

A salary sacrifice scheme deducts a portion of an employee’s wage, and in return, the employer gives them a benefit. The most popular benefit is an electric car salary sacrifice scheme.

Thanks to its reduced Benefit-In-Kind, income tax, National Insurance contributions, low maintenance and running costs, and a bundle of other benefits, salary sacrifice schemes for electric cars are a very attractive incentive for existing and new employees.

Is salary sacrifice a good idea for my business?

So, now you understand the basic principle of a salary sacrifice car scheme, is it something you should consider setting up for your business?

Attract new talent

Standing out from the crowd against other competing recruiters can be hard.

A fantastic incentive to attract the best talent is by offering a car salary sacrifice scheme.

Not only are you showing your care for your employees, but you’re offering an electric car that they perhaps otherwise could not afford.

Vehicle fleet discounts

A car salary sacrifice scheme allows your company access to vehicle fleet discounts, which means employees get new cars for much less!

So, you will be offering an attractive incentive for new and existing employees – at a discount!

Employee appreciation

Setting up an electric car salary sacrifice scheme for employees can help them feel appreciated which promises great results for your company.

How?

The domino effect.

Appreciating your employees could go a lot further than simply making them feel good.

Appreciation has the power to, not only motivate employees including those around them but, in the long run, have an incredible knock-on effect on the growth of your business.

Staff who feel valued and respected as people are much more likely to return the favour.

Did you know that 43% of employees become demotivated due to feeling invisible or undervalued?

Imagine 43% of your own employees feeling demotivated or unappreciated – how likely is that to spread to the rest of your employees, and affect your business long-term?

So, is salary sacrifice worth it for your business?

What you should be answering is: How much are your employees worth to you?

Inexpensive company car tax

Electric car salary sacrifice schemes return very little company car tax. The Benefit-In-Kind rate as of 2023/2024 is at just 2%.

Although employees still have to pay tax, when comparing this tiny 2% to a whopping 37% BIK rate on diesel cars – it seems like a well-worth deal.

Following on from appreciating employees, an employer who looks out for and ensures their staff are better off financially is much less likely to experience high employee turnover.

Reduced Income Tax & National Insurance

As you most likely already know, employers pay 13% of National Insurance (NI) contributions for each employee.

In an EV salary sacrifice scheme, because the employee’s salary is reduced that also means reduced tax and NI contributions – for employees and employers.

So, everyone can enjoy great money-saving benefits.

Green credentials

More and more businesses are taking steps towards reducing their carbon footprint and improving their green credentials.

An electric car salary sacrifice scheme is the perfect way to achieve this goal.

It works two-fold.

- Improve your company’s green credentials

- Employees feel good about reducing their CO² emissions on the roads

In fact, studies have shown those who take an active step towards improving their environmental footprint have improved overall well-being and mental health.

Just imagine the positive effect this could have on employees’ day-to-day mental well-being and work life.

It’s very simple. Happy employees = thriving business.

Employee loyalty

If you want to reduce the risk of losing employees, the best thing you can do is nurture your existing staff.

This is when an EV salary sacrifice scheme would be very much worth it for your company.

The thought of losing an employee may vary from business to business. For those who say “I can just replace them”, you’re not wrong. But guess by how much?

To replace 3 employees, you’re looking at around £90,000.

The domino effect.

If one of your best employee leaves, who’s to say this won’t influence the rest of your best talent?

By setting up a car salary sacrifice scheme, you will be nurturing your employees who have stuck with you and saving your business potentially hundreds of thousands of the big bucks.

Will it save my company money?

Setting up a car salary sacrifice can cost money to start with, but it doesn’t have to.

Some salary sacrifice car scheme providers do charge to set up the scheme for you. Some charge a monthly fee whereas others charge a percentage of monthly rentals.

What sets OSV apart?

OSV does not charge you to set up a standard salary sacrifice car scheme. For a bespoke service, there is a fee – however many other providers do not provide this option at all.

Let’s revisit the figures from earlier: the cost of losing an employee is around £30,000.

To reduce the risk of losing £30,000 you must invest in your employees.

If we look at car salary sacrifice as an investment in your new and existing employees, not only do you get to enjoy benefits such as reductions in NI employer contributions but you are also reducing the chance of losing £30,000 or possibly hundreds of thousands more.

So, yes. An electric car salary sacrifice scheme can save your company money.

When would salary sacrifice not be worth it for your business?

Credit check

To set up an electric car scheme your business will have to be credit checked. This is to ensure the company can demonstrate affordability.

If your business is not in good shape financially, then a salary sacrifice would not be worth setting up.

If the business is in good shape, however, then for the benefit of employees feeling valued and bettering retention among staff – then a salary sacrifice scheme is well worth it for your business

Employee wants to own the car

Typically, all vehicles are on a Business Contract Hire and there is no option for an employee or the company to purchase a vehicle at the end of the agreement.

As the employee is paying for the car through salary sacrifice, and enjoying all the benefits it has to offer – it has to be leased by the business, therefore it is a company car.

To avoid any surprises and disappointments it’s best to educate your employees and establish the salary sacrifice car scheme guidelines and rules from the start.

However, as part of the OSV Salary Sacrifice Scheme, we can discuss the best bespoke requirements where there could be the option to own.

Employees are on lower income

If the majority of your employees are on a lower income, and their taking part in a salary sacrifice scheme would take them below the minimum wage threshold – then setting up a scheme would not be suitable for your company.

An employer cannot allow employees to take part in a scheme where it takes them below the minimum wage. Even if they could just about make it, you have a responsibility for duty of care for your staff to ensure they are financially comfortable.

So, we would advise refraining from offering the scheme to employees that meet this threshold.

What if the employee damages the car?

If an employee damages the company car, then they are responsible for repairing it whilst in the contract. Some providers offer insurance to cover this.

Employers should note that they are responsible for the condition of the vehicle when it is returned to the leasing company.

What if an employee goes on maternity/paternity leave?

Once an employee is on maternity or paternity leave, they must still receive the car scheme benefit. The responsibility for this goes to the employer.

The employer must cover payments for the car if the employee’s pay goes below the statutory minimum.

An employee leaves

If an employee leaves your company whilst in a car scheme contract, then the payments of the vehicle is the responsibility of the employer to pay. This can include any remaining costs of the car.

Is there a solution to this?

Yes! OSV’s Early Termination Insurance. This covers you for:

- Employee resignation

- Long-term sickness absence

- Accidental death

- Maternity

- Adoption and Paternity

- Loss of license on medical grounds

For more information get in touch with us today.

Is salary sacrifice worth it for my company?

By now you may be thinking: “Is salary sacrifice worth it for my company?”

If you already have business goals in place such as improving employee engagement and retention, or possibly recruiting the best talent then an electric car salary sacrifice scheme is well worth considering.

Not only will you be growing your business and boosting workplace and employee morale, but your company will be saving money.

On top of this, your company’s green credentials will be greatly improved – something all businesses should strive to do with the 2030 ban on the sale of new ICE cars approaching.

Salary sacrifice employers FAQs 2023

- What is salary sacrifice?

- How does car salary sacrifice work?

- Are salary sacrifice car schemes worth it?

- What are the benefits of salary sacrifice for employers?

- What are the disadvantages of salary sacrifice for employers?

- Can salary sacrifice reduce tax?

- What should you consider before doing a salary sacrifice scheme?

- What if an employee leaves?

- What if the employee damages the car?

- Do companies need to have a certain number of employees to offer salary sacrifice?

- Can sole traders and the self-employed set up a scheme?

- Should salary sacrifice appear on pay slips?

- What do I need to tell HMRC?

- What if an employee goes on maternity/paternity leave?

- Does it cost my company anything?

- Am I responsible to pay for the car?

- Will it save my company money?

- How old does the company have to be?

- Can I do a salary sacrifice as the company owner?

- Should my company set up salary sacrifice?

Salary sacrifice is a fantastic opportunity for employers. Although it can seem like quite a complex concept, we’re here to change that.

Read on for all the frequently asked questions about salary sacrifice for employers.

What is salary sacrifice?

Salary sacrifice is an opportunity for employers to retain or gain new employees. Offering a salary sacrifice car scheme to employees can bring great benefits for a company, such as increased employee retention, engagement and loyalty. It can also save businesses big bucks.

It works by sacrificing a portion of an employee’s salary and putting this towards an employee benefit. The most popular salary sacrifice scheme is for electric cars.

How does car salary sacrifice work?

A salary sacrifice car scheme works by taking a portion of an employee’s salary, and in return, they get a brand-new car.

The benefit here is that employers are offering employees a new electric car for much less than if they were to buy it outside of salary sacrifice.

This is an opportunity for employees to drive an electric car that they otherwise might not be able to afford without the help of their employer. That’s right – expect a ‘Best Boss in the World’ mug at the Xmas party!

Are salary sacrifice car schemes worth it?

In an employee’s life, a car will be one of the biggest costs they make – on par with their house. As an employer providing a new car, this is undoubtedly a high-value favour.

If you’re looking to retain existing employees and want them to feel appreciated, a salary sacrifice car scheme is a fantastic opportunity to do this. Not only will they feel seen and heard, but they are likely to stay loyal if their needs are being met.

In car schemes for salary sacrifice, the cars leased are on corporate discounts. Which means vehicles are available at a reduced cost. For employers, this means access to fleet discounts.

What are the benefits of salary sacrifice for employers?

Benefits of salary sacrifice for employers include:

- Employee retention

- Attractive employee benefit

- Helps reach your company’s environmental goals

- Lower business expenses

- Pay less National Insurance contributions for employers and employees

- Vehicle fleet discounts available at the corporate rate

What are the disadvantages of salary sacrifice for employers?

- If an employee leaves then the car payments are left for the employer to pay – enquire for OSV’s solution

- Employers are liable for the credit and return condition of the vehicle – get in touch for solutions for return condition

- It uses up credit lines

- Need to pay Benefit-In-Kind National Insurance tax

Can salary sacrifice reduce tax?

One of the many reasons salary sacrifice is a popular scheme is due to its tax benefits.

Both employees and employers benefit from paying less income tax and National Insurance contributions.

This is because the salary is being reduced, therefore the percentage amount reduces with it.

What should you consider before doing a salary sacrifice scheme?

Before setting up a salary sacrifice scheme for your company, you should finalise which electric car scheme would best suit your employees and company.

Start with this list of the UK’s best electric car salary sacrifice scheme providers.

Next, you should consider the type of support you will need in setting up a salary sacrifice scheme:

- Do you need an account manager to help set up and run the car scheme?

- Do your employees need valuable information about salary sacrifice or electric cars?

- Would an employee salary sacrifice portal be worthwhile?

- Do your employees want access to the latest salary sacrifice electric car offers?

- Are various methods of virtual contact something that is needed for you and your employees?

- Would an all-in-one EV package including a home charger and installation be useful for your employees?

What if an employee leaves?

When an employee leaves, for whatever reason, this can leave employers with ‘debt’ as such, as they are responsible for the remaining costs of the car.

The employer can either continue to pay the monthly payments OR can pay an early termination fee.

An early termination fee is the responsibility of the employer. However, employers can protect themselves from this risk with ETI and a good salary sacrifice policy.

OSV offers an attractive Early Termination Insurance (ETI), ensuring you are covered for all areas of changes – subject to terms and conditions.

What does ETI cover?

- Resignation

- Long term sickness absence

- Accidental death

- Maternity

- Adoption and paternity

- Loss of licence on medical grounds

- Maternity/paternity/adoption leave

- Expatriation

It’s worth noting you cannot claim ETI within the first 3 months of your contract, and the first 9 months for maternity, adoption and paternity leave.

Another note for employers; when an employee takes maternity, adoption or paternity leave, the employer must continue to provide the vehicle.

What if the employee damages the car?

If the car is damaged during the contract, the vehicle must be repaired by the employee either through insurance or at their own cost.

Note: employers are liable for the return condition of the vehicle. Whilst fair wear and tear are allowed you should revise what damage is acceptable by the BVRLA.

Do companies need to have a certain number of employees to offer salary sacrifice?

No, according to HMRC there is no stated size a company has to be to take part in a salary sacrifice scheme.

Can sole traders and the self-employed set up a scheme?

No. HMRC states you need to be an employee to benefit from a salary sacrifice scheme.

This is because the employee and employer agree to alter the terms and conditions of employment for the employee to receive a benefit in lieu of salary.

Should salary sacrifice appear on pay slips?

Yes. It should be evident on pay slips when an employee is in a salary sacrifice scheme.

The contributions should clearly show the deductions made before tax and national insurance contributions are applied.

If the employee’s salary sacrifice doesn’t appear clear on pay slips, you must raise this with your payroll department immediately.

What do I need to tell HMRC?

You do not need to report anything to HMRC about offering a salary sacrifice scheme. When it comes to reporting the end-of-year expenses at the end of the tax year, then you must report the benefits.

Usually, HMRC likes to see:

- Evidence of the variation of terms and conditions (if there is a written contract)

- Pay slips before and after the variation

What if an employee goes on maternity/paternity leave?

If an employee goes on maternity or paternity leave whilst on the salary sacrifice car scheme, the car payments are left to the employer to cover.

There is a way around this to avoid any surprise costs. Early Termination Insurance covers employee leave including parental leave.

Does it cost my company anything?

Salary sacrifice can be completely free to set up – depending on the provider you choose. OSV offers a free set up for a standard salary sacrifice car scheme. For a more bespoke service, there is a fee – however other providers do not offer this option at all.

As the employer, you pay the initial upfront cost for the car and the employee pays you back over the course of the agreement.

Salary sacrifice car schemes actually save employers money due to paying fewer employee national insurance contributions.

If anything, companies can end up making money from salary sacrifice schemes.

Am I responsible to pay for the car?

As the car is hired on a salary sacrifice, it is not owned by the employee. It is a company car, leased by the business.

So, the employee is sacrificing a portion of their salary to pay for the car. However, payments can fall onto the employer if the following happens:

- An employee leaves due to maternity, paternity or adoption leave

- An employee is absent due to long term sickness

- Accidental employee death

- An employee loses their driving license on medical grounds

- An employee resigns

- An employee is expatriated

OSV offers Early Termination Insurance to cover any of these events.

The employee is responsible for costs such as charging the car, parking fines, repairs for any damages, going over the agreed annual mileage and any increases in road tax.

Will it save my company money?

Yes! Not only are you offering tax and national insurance (NI) reductions for your employees, but as an employer, you pay less employee NI contributions too. Win-win!

How old does the company have to be?

According to HMRC legislation on salary sacrifice for employers, there is no stated length in days, months or years of how old a company has to be to offer a salary sacrifice scheme to its employees.

Can I do a salary sacrifice as the company owner?

HMRC states the definition of a salary sacrifice scheme as “an agreement to reduce an employee’s entitlement to cash pay, usually in return for a non-cash benefit”.

There is no mention of any employer or company owner being allowed to benefit from this salary sacrifice agreement.

Technically a director of a company is an employee of a Limited company, so they would be eligible. But, depending on how the director is paid will depend if it’s worthwhile – this is a question for your accountant.

Should my company set up salary sacrifice?

Now that we’ve gone through what salary sacrifice is, how it works and the most important frequently asked questions about salary sacrifice, do you think your company should set up salary sacrifice?

If you are looking to increase employee retention, engagement and loyalty, save your business money and increase your company’s green credentials – then it really is a no-brainer.

Are there any questions we’ve missed? If so, share them in the comments below and we will respond to your query.

What are the disadvantages of salary sacrifice car schemes?

Salary sacrifice car schemes are the new kid on the block, and although they have many attractive advantages, what are the disadvantages of salary sacrifice car schemes?

The downsides of salary sacrifice completely depend on the scheme you choose. Some may only offer a limited number of cars; usually valuable resources and an employee portal is available but this isn’t the case for all salary sacrifice car schemes.

When shouldn’t you take part in a salary sacrifice scheme? Why is it better suited for electric cars? And, when is salary sacrifice simply just not worth it? Read on for everything you need to know…

Disadvantages of Salary Sacrifice for Employees

When shouldn’t you take part in a salary sacrifice car scheme?

So, perhaps you’ve heard the benefits of a salary sacrifice car scheme, such as saving up to 40% in taxes. Who wouldn’t want to save money?!

Whilst these benefits are tempting, it’s important to consider when you shouldn’t take part in a salary sacrifice scheme.

Need flexibility

If you are someone who is often quite indecisive and changes your mind, it’s vital to remember that an employee cannot hand the car back if they change their mind about the car.

We would recommend thoroughly researching beforehand to get an idea of what you like. Consider what your needs are and what you want to be getting from a car that you will be driving every day. A good place to start is watching car reviews.

Lower incomes

If you have a lower income, then it’s likely a salary sacrifice car scheme won’t be ideal for you, as it could take you below the minimum wage. You should also consider any other big payments you are making such as a mortgage, loans or rent, and how another payment on top would affect your day-to-day lifestyle.

Reduction of salary

If taking part in a salary sacrifice car scheme were to reduce your salary below the minimum wage threshold, then not only are you not allowed to partake in the scheme, but it also would be an extremely irresponsible idea.

Why is this?

Reducing your salary could impact a few things including:

- Credit or mortgage applications

- Pension amounts

- Life cover offered through work

- Level of maternity pay you receive

It’s vital you consider all aspects and consider whether this is suitable for you.

Intention to buy

If you are intending to purchase the car at the end of the agreement, then a salary sacrifice car scheme is not ideal for you.

Nearly all schemes do not offer a purchase option at the end, and if they do, the value of the car cannot be known until the final month of the agreement.

On the plus side, a salary sacrifice car scheme means not worrying about the depreciation of the value of the car.

Instead of worrying about this, you can look forward to getting a brand-new car after the scheme.

Restricted mileage

If your daily commute or annual trips often vary, and predicting your annual mileage is tricky, it’s important to know that in a salary sacrifice car leasing scheme your mileage is limited.

You usually sign up and agree to a set number of miles per year, and this can be between 5,000 and 40,000 miles a year, most salary sacrifice cars are relatively low mileage at around 7,000 miles a year.

Drivers do have the option to increase their mileage by paying a little more each month, and the agreed annual mileage may be altered during the agreement.

However, this is at the discretion of your finance provider, so you would need to contact them to request amending the annual mileage.

Most do not allow drivers to amend the mileage within the first 12 months of the contract, but we would advise contacting the finance house directly to understand their terms and conditions.

Why shouldn’t you do salary sacrifice on a petrol or diesel car?

It’s likely you’ve heard a lot about salary sacrifice car schemes on electric cars more than petrol and diesel models. There is good reason for it.

Electric cars have an outstanding number of pros when you get one through salary sacrifice.

Even without salary sacrifice, EVs promise reduced maintenance and charging costs, ULEZ (Ultra Low Emission Zone) and CAZ (Clean Air Zone) exemptions and much more.

Through salary sacrifice, electric cars return a much much lower BIK (Benefit-In-Kind) rate than their fuel counterparts.

Currently, as of 2023/2024, EV owners are expected to pay 2% BIK. For diesel and petrol drivers, this goes right up to 37% BIK.

That’s less money in your pocket, and more CO₂ in the air.

Disadvantages of Salary Sacrifice for Employers

When would salary sacrifice not be worth it?

So now we understand how salary sacrifice can affect your finances, and how it is better suited for electric cars, how about when salary sacrifice would not be worth it?

Employee leaves

Life can be unpredictable; changes happen and sometimes employees leave. What does this mean for the employer?

This can leave employers with ‘debt’ as such, as they are responsible for the remaining costs of the car.

What can the employer do when this happens?

They can either continue to pay the monthly payments OR they can pay an early termination fee.

An early termination fee is the responsibility of the employer. However, employers can protect themselves from this risk with ETI and a good salary sacrifice policy.

OSV offers an attractive Early Termination Insurance (ETI), ensuring you are covered for all areas of changes – subject to terms and conditions.

What does ETI cover?

- Resignation

- Long-term sickness absence

- Accidental death

- Maternity

- Adoption and paternity

- Loss of licence on medical grounds

- Maternity/paternity/adoption leave

- Expatriation

It’s worth noting you cannot claim ETI within the first 3 months of your contract, and the first 9 months for maternity, adoption and paternity leave.

Another note for employers; when an employee takes maternity, adoption or paternity leave, the employer must continue to provide the vehicle.

Why is this?

The employee will receive statutory pay for their leave, and the salary cannot be sacrificed from this. So, the employer must cover the costs of the vehicle throughout the time the employee is on leave.

Should you sign up to a salary sacrifice car scheme?

Now that we’ve gone through the cons of salary sacrifice when getting a car, does this sound like something appealing to you? Remember, a salary sacrifice car scheme is only available once the employer has signed up for one.

If the disadvantages haven’t put you off, and this does sound like something valuable to you, OSV can help.

Many suppliers assume employers have a fleet team ready to manage all the admin and paperwork, and often don’t offer the help. OSV’s salary sacrifice scheme is designed to take the weight of your shoulders.

Setting up a salary sacrifice scheme for employees in 2023

- How can your company benefit from Salary sacrifice?

- What to consider before setting up a salary sacrifice scheme

- How do you set up a salary sacrifice scheme?

- Should you set up a salary sacrifice scheme?

Do you need advice on setting up a salary sacrifice scheme for your company? Well, you are in the right place. There are many reasons both employees and employers are falling in love with salary sacrifice schemes.

From employees saving up to 40% in taxes and employers paying less national insurance contributions, it’s no wonder salary sacrifice electric car schemes are becoming the new way to get a car.

Although we can expect salary sacrifice to take over, not many employees are even aware of its existence. It is imperative to educate staff about this employee benefit, as there is no point in setting up a salary sacrifice scheme if your employees aren’t interested.

How can your company benefit from setting up salary sacrifice?

- Employee retention

- Attractive employee benefit

- Helps reach your company’s environmental goals

- Lower business expenses

- Pay less National Insurance contributions for employers and employees

What to consider before setting up a salary sacrifice scheme:

- What are your company goals?

- Is employee retention a key goal?

- Do you want to boost your company’s green credentials?

- Do you want to attract new talent?

- Do you want to increase staff productivity and engagement?

Understanding what your company wants from an electric car scheme is a vital first step to ensuring you select the right one for your employees and business.

- What do your employees want?

- Do they need a better understanding of salary sacrifice?

- Are they even interested in the scheme?

- Is there a brand or type of electric car everyone likes?

- What is their budget?

- Do they need extra add-ons such as a home charger and installation?

It’s questions like these which will help find the perfect scheme for your staff, also saving time and money in the long run.

What is the point in setting up a scheme that doesn’t suit your employee’s needs? Make sure to listen to your employee’s wants and requirements.

- What is your company budget?

- Salary sacrifice schemes can vary in cost to set up, however, you should budget for emergency spending in case the following occur:

- An employee resigns or leaves the company costing the business an early termination fee – this can be avoided with Early Termination Insurance (ETI)

- An employee is on long-term sick leave leaving the lease costs to the company – this is covered under ETI

- The car is returned exceeding fair wear and tear conditions

- Salary sacrifice schemes can vary in cost to set up, however, you should budget for emergency spending in case the following occur:

What is Early Termination Insurance? OSV offers this insurance which gives coverage for situations such as those mentioned previously. ETI gives the employer protection against charges for returning a lease vehicle early, subject to terms and conditions.

Remember, although any lease costs and fees can be deducted from an employee’s pay, the employer must cover the costs first.

Before setting up a salary sacrifice scheme for your company, you should finalise which electric car scheme would best suit your employees and company. Start with this list of the UK’s best electric car salary sacrifice scheme providers.

Next, you should consider the type of support you will need in setting up a salary sacrifice scheme:

- Do you need an account manager to help set up and run the car scheme?

- Do your employees need valuable information about salary sacrifice or electric cars?

- Would an employee salary sacrifice portal be worthwhile?

- Do your employees want access to the latest salary sacrifice electric car offers?

- Are various methods of virtual contact something that is needed for you and your employees?

- Would an all-in-one EV package including a home charger and installation be useful for your employees?

Understanding the support that you and your employees need will help narrow down the perfect salary sacrifice scheme provider for you.

How do you set up a salary sacrifice scheme?

So, now you know what to consider before setting up a salary sacrifice scheme, what about actually setting one up?

Let’s go over how to set up a salary sacrifice scheme…

Remember to find what best suits your employees, after all they are the ones who will be mostly impacted by the scheme your company chooses.

We would advise selecting a provider that takes the weight off your shoulders. This means managing the entire process, from researching cars and organising breakdown cover and maintenance packages, to answering all questions employees have along the way.

The salary sacrifice car scheme process is different for each provider. We would advise choosing your provider based on the needs of your staff, rather than selecting a provider that promises a fast salary sacrifice turnaround time.

A fast-paced scheme that doesn’t fully suit the needs of your staff, increases high risk of problems later down the line such as employee turnover and decreased engagement.

If the employees don’t feel listened to and don’t feel their needs are being met with the right car or driving requirements, why would they stick around?

OSV follows a consultative process to ensure we fully listen and understand the needs of the driver. We pride ourselves on our human-oriented values and working in the motor trade since 1997.

So, what happens in an OSV salary sacrifice car scheme?

OSV’s salary sacrifice process:

- Book a consultation to discuss your needs and set up requirements

- Fill out finance proposal form to get pre-agreed credit lines

- Fill in an insurance application to get pre-approval

- Provide us with key contacts and who has what authority in the company

- Receive a unique customer code

- Drivers register and login via the Salary Sacrifice Portal

- Employees can run quotes on the portal

- Pick colour, extras and personalise the vehicle

- Order the car via the portal

What else is included in OSV’s salary sacrifice scheme?

- Payroll advice including how to do HMRC reporting

- Tailored web portal for employees

- Communication advice about the scheme and its impact to employees

- Creating general policies

- Car maintenance package (charged per vehicle)

- Early Termination Insurance (charger per vehicle)

- Car insurance

- Optional relief vehicle

- Quotation engines and calculation tools e.g. EV cost per mile calculator

- Salary sacrifice policies

- Your very own salary sacrifice expert will carry out FREE consultations with each staff member that is interested

Please be aware that the following is not included in the scheme:

- Your order sign-off and eligibility of employees to the scheme

- Submission of P11d information to HMRC

- Employee dispute advice

- Make a business plan

Once you know what your chosen salary sacrifice car scheme offers, get in touch with the provider to find out their process and what you need to do on your side.

This will make your life a lot easier when creating the plan for launching the scheme in your company.

What should the plan include?

- Explanation of how the scheme works with your company

- The benefits AND disadvantages of the scheme

- Risk management factors covering employees leaving or resigning

- A timeline from setting up the salary sacrifice scheme to employees receiving their car

Once you’re happy with the plan, next you should educate your staff to get an idea of how many will sign up for the scheme.

Choosing how you communicate this information will be vital to the success of the scheme. For effective communication with employees, we recommend regularly discussing the benefits of setting up a salary sacrifice scheme.

This can be done through an open discussion in regular meetings, or more formal ways are through email, newsletters, staff magazines or forums.

- Educate your employees

Salary sacrifice can be a tricky one to grasp at first, which is why it is so important to regularly engage with your employees and remind them how it works.

Staff may misunderstand the implications the scheme has on their tax, salary, applying for a mortgage and their pension scheme.

It is vital your employees fully understand how the scheme will affect them personally, but also regularly talk about the benefits, and why it will be well worth their while to sign up.

To avoid any employees missing out, we recommend creating a company-wide email for an introduction to salary sacrifice car schemes and their benefits.

You could introduce the scheme and ask staff to express interest if they would like to take part, use our article on Salary Sacrifice: Explained for a thorough and easy beginner’s guide to salary sacrifice car schemes.

- Remind your staff of the benefits & disadvantages

Once your employees have been educated on why setting up a salary sacrifice scheme is a good idea, you should prioritise reminding them of the benefits and why they should sign up.

Remember to utilise your provider’s resources on the scheme. Salary sacrifice is a complex concept. So, a good place to start is to send content such as ‘What is Salary Sacrifice’, the benefits of salary sacrifice for the workplace, and a list of FAQs to answer any questions they will likely have.

This will not only provide the support your employees need, but it will also save you a huge amount of time.

If your provider assigns an account manager to support your employees, make sure to use them! OSV’s Salary Sacrifice specialists assist with car research and selection, delivery, and business assistance including payroll advice, HMRC reporting and all car-related queries.

- Sign up for your salary sacrifice car scheme

Once you are confident and ready in the salary sacrifice car scheme provider, there is no requirement to send anything to HMRC initially.

The only time they must be advised is when you send your Benefit-In-Kind return once a year.

When an employee opts into a salary sacrifice scheme, it is the employer’s responsibility to amend the contract accordingly. This must include the correct payments and deductions of tax and National Insurance contributions for the employee benefit, which in this situation will be the electric car.

Need payroll advice and help reporting contract changes to HMRC? Get in touch with a salary sacrifice specialist today for expert knowledge and guidance.

Should you set up a salary sacrifice scheme?

If we take into consideration the huge number of benefits up for grabs, for both parties, setting up a salary sacrifice scheme seems like a no-brainer.

With OSV, setting up a salary sacrifice scheme is a very simple process, we work to take the weight off your shoulders.

If you think an electric car scheme would be beneficial for your company and are considering setting up a salary sacrifice scheme, the best place to start is OSV’s Salary Sacrifice Hub. Discover the benefits of salary sacrifice, FAQs, guides and more.

When you have spoken to your employees, and both you and they are ready to get the ball rolling, we are here to help and support you both along the way.

Salary Sacrifice portal: how do I use it?

- What is the salary sacrifice portal process?

- How do I start a quote?

- How do I change my details on the salary sacrifice portal?

- Can I change my contract details after ordering a car?

- Can I change or add optional extras after ordering a car?

- Can I see the order updates?

Has your employer offered you a salary sacrifice scheme? Are you ready to get the ball rolling and order your new EV with OSV? Today we’re taking you through a step-by-step process of how to use OSV’s salary sacrifice portal.

What is the salary sacrifice portal process?

First things first, you will need to register your account on the salary sacrifice portal before you can access anything like vehicles available and price quotes. To do this visit the portal and simply enter basic details including your name, email address, number, salary and so on.

Before an employee can use the OSV portal, the business they work for must have signed up. If they have not done this, read this guide on convincing the boss to sign up to salary sacrifice.

You will need the company number of the business you work for. If you are unsure about this, get in touch with your employer to confirm the company ID before registering.

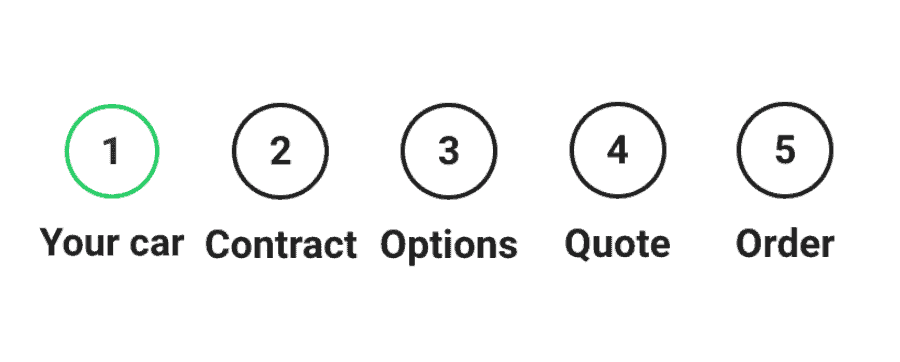

The process starts by selecting your electric car, amending the contract to your needs and adding any extra features. Once you’ve done this you will receive a quote and you can order your car!

How do I start a quote?

Once you have signed up to the OSV Ltd salary sacrifice portal, you can begin your vehicle journey.

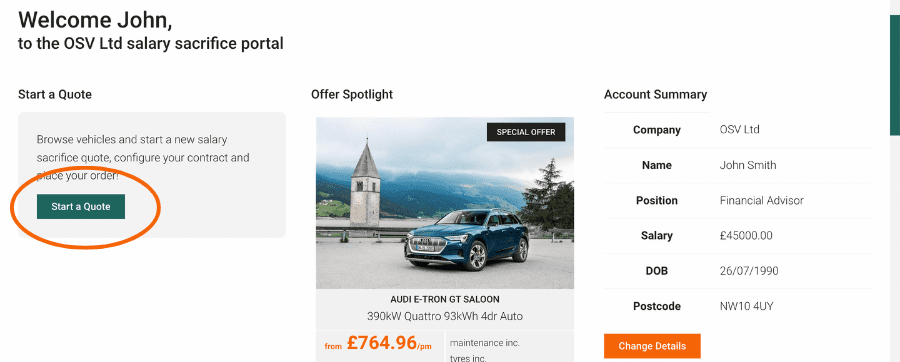

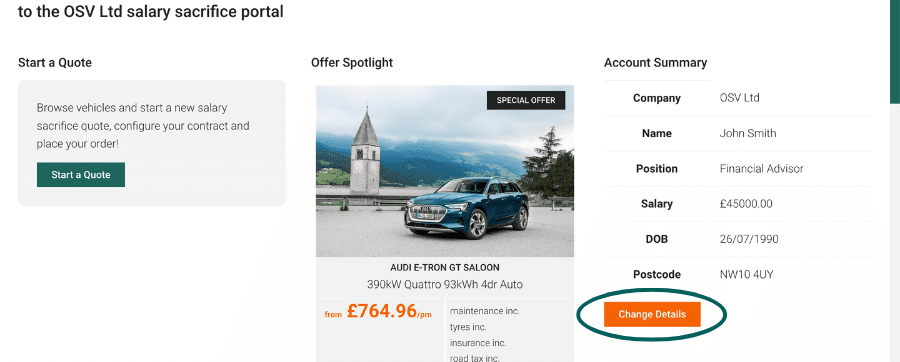

Let’s use the case study of John Smith, the financial advisor for OSV Ltd.

Once John has signed up he is met with the welcome page, as seen below. We recommend reviewing the ‘Account Summary’ section on the right, to ensure all details are correct.

Once John has checked this, he can browse the electric vehicles on offer by selecting ‘Start a Quote’.

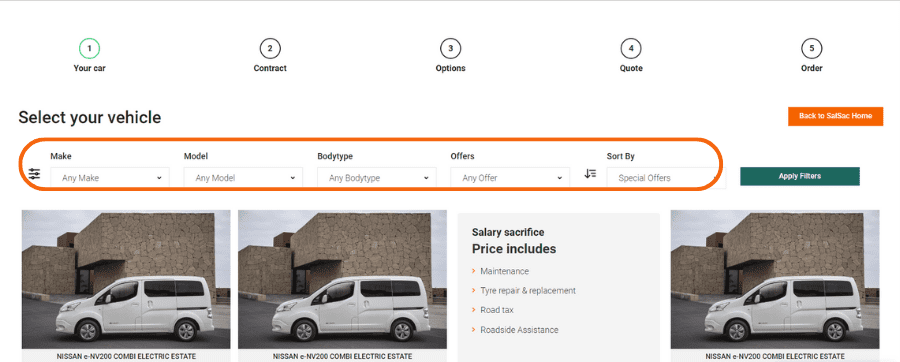

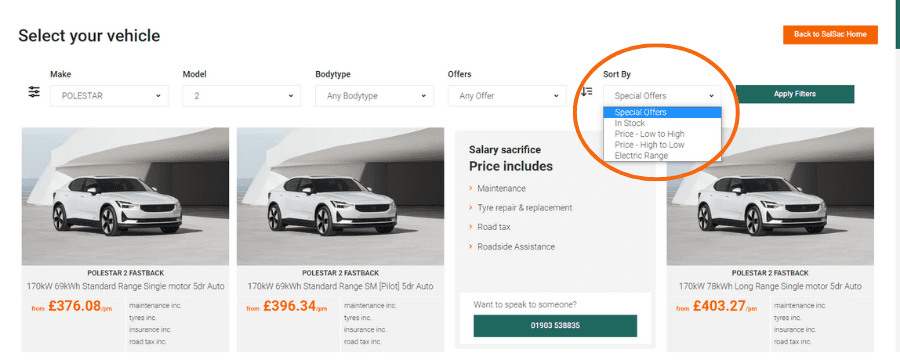

This will take John to the ‘Select your vehicle’ page. Here he can filter cars by make, model, body type and offers.

Or he can sort by special offers, in stock, electric range and high or low pricing.

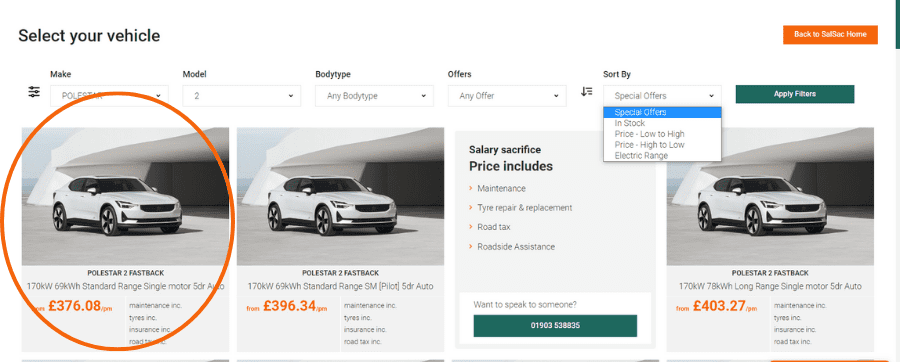

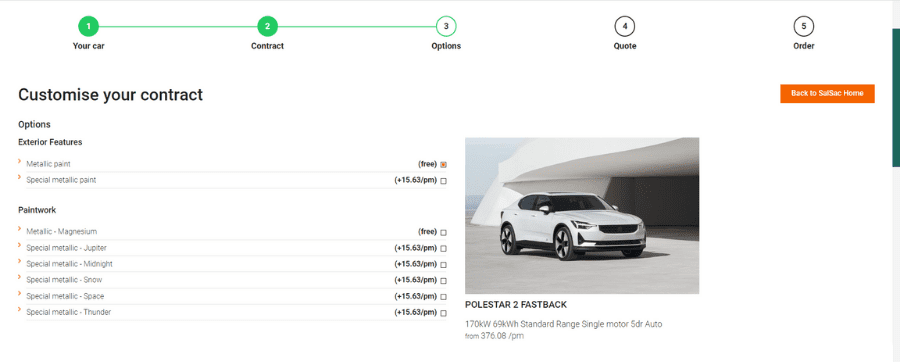

John wants a Polestar 2, because they are amazing – in his opinion. He filters the make and model to Polestar 2, and a page of offers shows. He selects the £376.08 per month offer.

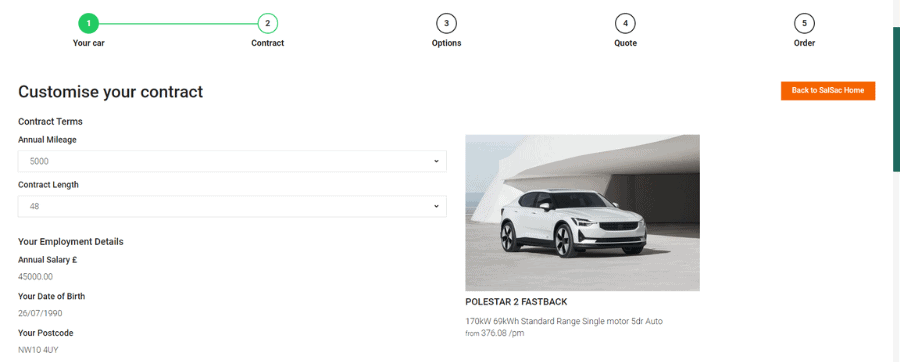

Once selecting this car, John is taken to a page outlining the contract details. Here he can alter the contract to fit his needs.

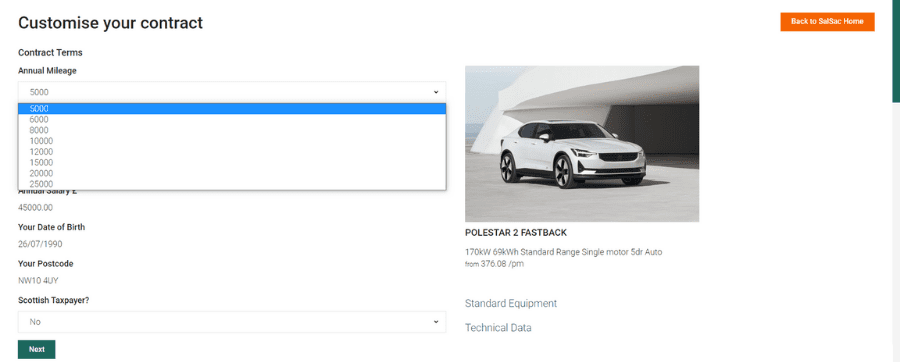

John can alter the annual mileage. We advise choosing between 5,000 and 8,000 miles for the average driver. You can increase this during the contract, subject to additional mileage charges and the employer and leasing company’s approval.

Some conditions do apply, get in touch with us for further information.

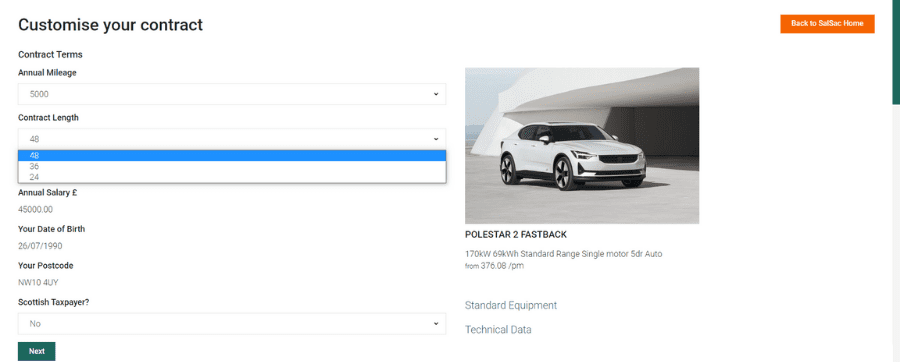

John can change how long he has the car. The bare minimum is 2 years and the maximum is 4 years.

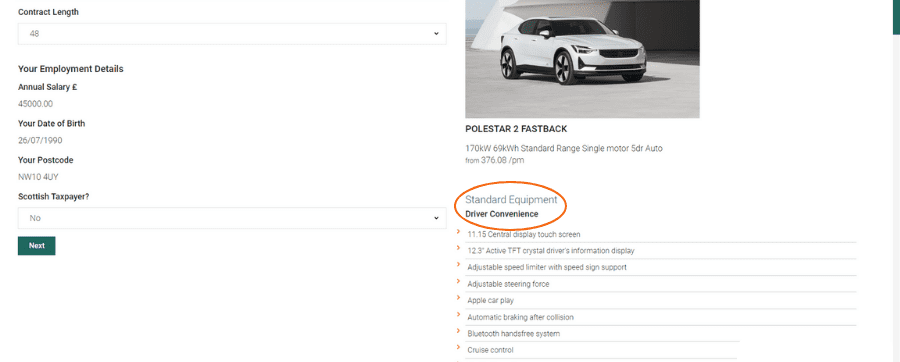

For more information about the vehicle, John can select ‘Standard Equipment’.

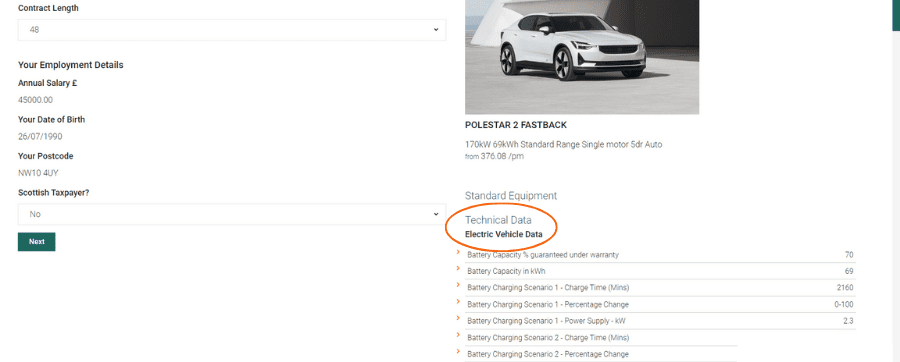

If John wants to know more of the technical data, he can access this by selecting ‘Technical Data’.

Once John is happy with the overall contract including the annual mileage and contract length, he can go to the next stage of the journey – added options.

Optional extras variate between different vehicles. For the Polestar 2, this ranges from types of paintwork, wheels and interior trim. This is the final stage before requesting the quote for the vehicle.

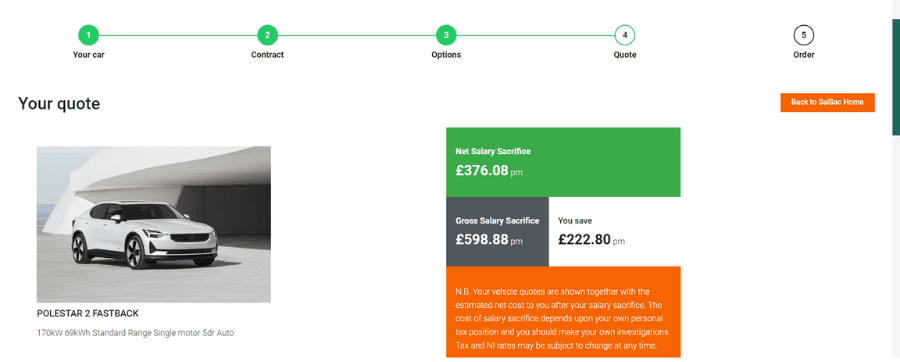

After John has selected all the extras he would like, now is time to select ‘Get Quote’.

If you are not satisfied with the final quote, you can go back and make changes to the contract and added features to amend the final price.

This is a good way to visually see and test what you actually need versus what you would like.

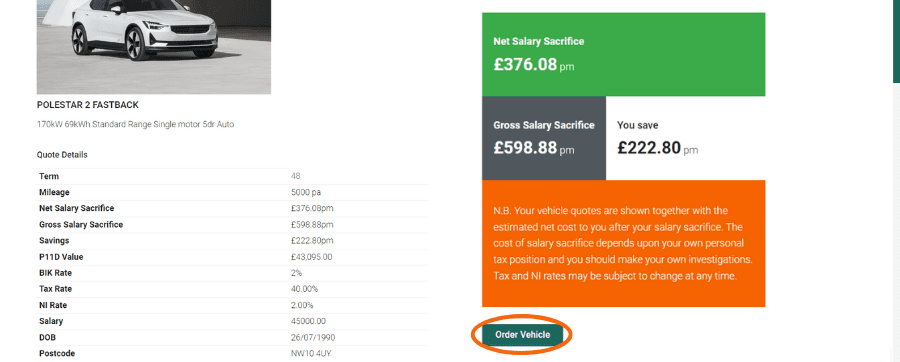

This page also clearly shows how much John is going to be saving by getting the Polestar 2 through salary sacrifice and how much it deducts from his salary.

Once John is satisfied with the quote, he can go ahead and order his Polestar 2!

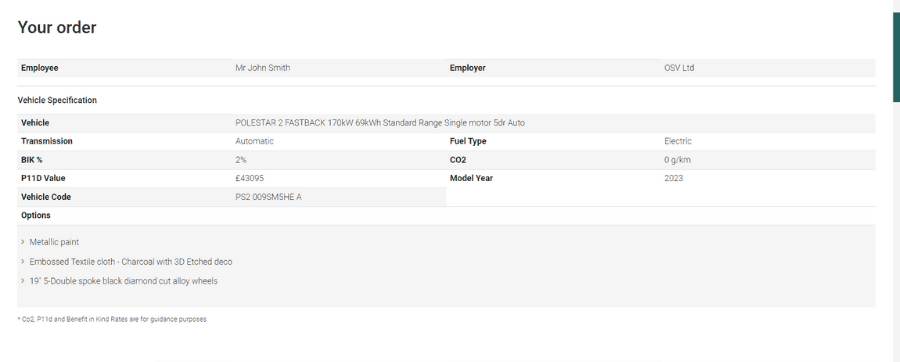

Before the final order submission, John should read and review his order form, ensuring all personal, vehicle and contract details are correct and he is happy.

Next, it’s important to read the terms and conditions including cancellation rights. We recommend thoroughly reading this before submitting the order.

If you require any further information or have any questions about this, please contact your dedicated account manager who will help.

Once everything has been read, checked, and signed (electronically) and the order form submitted, then you are done!

Your employer will be sent details of your order for approval. Once your order has been approved you will be sent confirmation of your order details.

How do I change my details on the salary sacrifice portal?

Changed your name? Moved address? Prefer to use a different email? Not to worry.

You can change your details at any point whilst in a salary sacrifice scheme.

To do this, simply visit the homepage of the OSV Ltd salary sacrifice portal. On the right under ‘Account Summary’ select the orange button ‘Change Details’ (as seen below).

Can I change my contract details after ordering a car?

Up until the finance documents are signed by your employer you can change the contract details including the mileage and contract length.

But once the vehicle has been delivered, the only thing that can be changed is your mileage allowance which can be increased subject to approval by your employer and the lease company.

By increasing your mileage your salary sacrifice contribution would also increase.

Can I change or add optional extras after ordering a car?

This depends on the stage of production of your vehicle. You should contact your account manager to discuss if any options exist.

A vehicle which has been manufactured cannot be changed, this is also known as a ‘stock’ vehicle.

Vehicles which have not gone to production may be able to be changed, although this may affect waiting time for the vehicle.

Can I see the order updates?

Once the order has been placed with the manufacturer, you will be given access to your own vehicle update portal.

Here you can see status updates on where the vehicle is and how it’s progressing.

Salary sacrifice for employees FAQs 2023

- What is salary sacrifice?

- How does car salary sacrifice work?

- Are salary sacrifice schemes worth it?

- How does salary sacrifice for employees work for EVs?

- What are the benefits of salary sacrifice for employees?

- What are the disadvantages of salary sacrifice for employees?

- What is the maximum salary sacrifice?

- Who can salary sacrifice a car?

- Can salary sacrifice reduce tax?

- Will salary sacrifice affect my pension?

- How does minimum wage and salary sacrifice work?

- Do I own the car?

- Does it have to be a new car?

- Does it have to be an electric car?

- Can you get more than one car on a salary sacrifice scheme?

- What happens if I go on maternity leave?

- What happens if I leave the company?

- How long is salary sacrifice for?

- Does it come with insurance?

- What should you consider before doing a salary sacrifice scheme?

Heard about car salary sacrifice for employees? Not quite sure you’ve grasped the concept quite yet? We don’t blame you. A salary sacrifice car lease scheme for employees can seem like quite a complex concept, but we’re here to change that.

Read on for all the frequently asked questions about salary sacrifice for employees.

What is salary sacrifice?

Salary sacrifice is an incentive promoted by employers to either retain or gain new employees. It also allows significant benefits to the employee.

The scheme involves taking a portion of the employee’s salary in order for them to gain something in return.

This can vary from many products and services such as healthcare, childcare, gym memberships, and more. The most popular scheme is a salary sacrifice car scheme.

How does car salary sacrifice work?

It works by taking a portion of the employee’s salary in return for a brand-new car.

When you lease a car through salary sacrifice, you are essentially getting a car for less!

You deduct a small portion of your wage and in return, you get a brand-new car.

This is usually a lease finance scheme, so whilst you can drive it around to and from work, park it at home and use it for personal trips on the weekend – it is the property of the lease company which has an agreement with your employer.

Here is a working example:

John wants an electric car. His salary is £36,000 per year or £3,000 per month.

After-tax his take-home pay is £2,350.79 a month (the tax year of 2022).

If he leases an electric car worth £300 a month, without salary sacrifice, he will be left with £2,050.79 a month after tax.

What if he leases an EV through salary sacrifice?

The benefit here is he can pay the £300 (cost of EV) before tax is deducted.

So, you do not pay income tax or national insurance contributions on this £300.

If he leases an electric car worth £300 a month, he will be left with £2,150.54 a month after tax.

That is a total saving of £99.75 a month with salary sacrifice! So, you are only paying £200.25 a month for a brand-new car worth £300 per month.

Are salary sacrifice car schemes worth it?

Yes, as you get a new car costing you less than what you could get outside of the scheme which also includes servicing, road tax, and maintenance. All of which is paid before tax and national insurance deductions from your salary.

How does salary sacrifice for employees work for EVs?

The general rule of thumb is lower emission vehicles ensure a lower Benefit-In-Kind rate, which is the tax you pay on your salary sacrifice company car.

So, electric cars are fantastic to opt for, as they are zero emissions and do not have an engine just an electric motor. It’s also another reason why they are a popular choice when employees select their car through the scheme.

What are the benefits of salary sacrifice for employees?

- With an electric car salary sacrifice scheme, a home charger can be included with your lease

- A brand-new vehicle that exists within the scheme

- Pay less tax and National Insurance (NI)

- Access to corporate discounts which means a reduced vehicle cost

- The agreement includes maintenance, servicing and road tax

- Easy fixed monthly payments with no credit check

What are the disadvantages of salary sacrifice for employees?

A disadvantage to salary sacrifice is that it does reduce your salary which may in turn affect your pension contributions.

Another disadvantage is that you are committed to the vehicle for the period of the lease and you would have to hand your vehicle back if you were to leave your employer.

If you damage the vehicle or it becomes damaged whilst in your control you may be liable for repair costs.

What is the maximum salary sacrifice?

This will depend on your earnings and what an employer is prepared to offer you.

The main priority for an employer is that the scheme will not take the employee’s salary below the national minimum wage.

You should not enter into a salary sacrifice where your take-home pay would not comfortably cover your other commitments.

Who can salary sacrifice a car?

If you are an employee working at a company where a salary sacrifice scheme is available, and your wage allows you to partake in the scheme, then you should be able to salary sacrifice a car.

Can salary sacrifice reduce tax?

Yes, it can reduce income tax on your personal contributions as you are paying tax on a reduced salary.

Salary sacrifice for employees also allows reduced national insurance contributions.

Will salary sacrifice affect my pension?

As you are reducing your salary, if your pension contribution is based on a percentage of your salary then your monthly contributions would reduce pro-rata in most cases.

How does minimum wage and salary sacrifice work?

If after the salary deduction, your wage has been taken to below the national minimum wage, then you will not be able to take part in the scheme.

Even if you just about make it, you should always ensure you have a salary that is comfortable enough to live on whilst considering the cost of your own personal lifestyle.

Do I own the car?

No, salary sacrifice car schemes are usually done on a lease agreement so the vehicle is the property of the lease company which has an agreement with your employer.

At the end of the agreed contract on the vehicle, you will hand this back and have the opportunity to choose a new vehicle via the salary sacrifice scheme again.

Does it have to be a new car?

Yes, which is why it is such a great perk to take advantage of!

Does it have to be an electric car?

We would recommend you opt for electric as you would be maximising the benefits of the scheme.

Can you get more than one car on a salary sacrifice scheme?

As long as your salary allows it, and the extra salary sacrifice car does not take you below the national minimum wage, then there is no reason why you cannot get more than one car on a salary sacrifice scheme – subject to your employer’s approval.

What happens if I go on maternity leave?

When an employee goes on maternity or paternity leave, their employer is responsible for still providing the salary sacrifice benefit including a car.

The employee can continue to use their company car, and the employer will cover payments for the car if the employee’s pay goes down to statutory minimum amounts.

What happens if I leave the company?

The car lease scheme for employees on a salary sacrifice is a company car, so it is the property of the business. When an employee leaves their job, the car doesn’t come with them.

This will be left to the employer to keep and carry on paying the rest of the agreement costs.

How long is salary sacrifice for?

A salary sacrifice scheme can last from 24 months to 36 months. It can be extended from 36 to 48 months, but a 48-month contract cannot be set in stone at the start.

Does it come with insurance?

Salary sacrifice generally does not come with insurance. However, this comes down to which salary sacrifice provider you use.

OSV offers insurance for your electric car salary sacrifice scheme, along with a home charger and installation, maintenance and servicing.

What should you consider before doing a salary sacrifice scheme?

- Take-home pay will be reduced which could affect how much you can borrow, for example, if you plan to get a mortgage.

- You pay less NI which may affect your state pension; however, this will only happen if your reduced salary takes you beneath the threshold to make NI contributions.

- Strictly, employees have no right to buy the vehicle and will never own it.

- If the employee’s driving licence is revoked due to health, they either must continue payments or they can be covered by insurance. It’s worth looking into getting this covered.

- Although you pay less tax on your salary, you still must pay company car tax on your vehicle. If you are driving a low-emissions car, like an electric then this will be a much lower tax band compared to that of petrol or diesel.

At present (2023) EV drivers pay a 2% benefit-in-kind rate, which is 2% of the vehicle cost.

If you were to opt for a petrol or diesel car, this could go right up to a 37% benefit-in-kind (BIK) rate.

Now we’ve gone through what salary sacrifice is, how it works and the most important frequently asked questions about salary sacrifice. Are there any questions we’ve missed? If so, share them in the comments below!

Are salary sacrifice car schemes worth it in 2023?

- Is EV salary sacrifice worth it?

- When are salary sacrifice car schemes worth it?

- When are salary sacrifice car schemes not worth it?

- Are salary sacrifice car schemes worth it?

Are salary sacrifice car schemes worth it?

1 in 4 doesn’t think the idea of salary sacrifice is a positive one. Are they right to think so? Or does the term ‘sacrifice’ raise brows for no good reason?

Let’s investigate and answer the question: are salary sacrifice car schemes worth it?

Is EV salary sacrifice worth it?

Is electric vehicle salary sacrifice worth it? Getting an electric car through a salary sacrifice scheme is the best way to take advantage of money savings and value.

Not only are you promised low running and maintenance costs, but the Benefit-In-Kind (BIK) rate, which is the tax you pay for a company car, is outrageously low for electric cars.

Because EVs emit so little CO² drivers pay a lovely 2% BIK. For a base Tesla Model Y in the tax year 2023/2024, drivers pay just £1,099 a year.

Compared to a whopping 37% BIK rate for diesel models, which can go up to many thousands, paying just a 2% BIK rate is just one of many reasons people are choosing to switch to electric.

On top of this, you are helping to reduce your personal carbon footprint on the roads whilst cruising through cities without facing any congestion charges. Woo-hoo!

When are salary sacrifice car schemes worth it?

Now you know why electric cars are the best vehicles to go for if you want to take full advantage of the salary sacrifice scheme’s benefits. What about the general benefits? When are salary sacrifice car schemes worth it?

New car for less

If you are looking to get a new car, especially if it’s electric, then there are a million reasons why salary sacrifice car schemes are worth it. You get a brand-new electric vehicle for less than if you were to get it outside the scheme.

Tax & National Insurance

Whilst also getting a brand-new car, you get to enjoy paying less tax and national insurance (NI) contributions. Employers pay fewer employee NI contributions too!

Are salary sacrifice car schemes worth it for employee appreciation & loyalty?

If you’re looking to retain existing employees and want them to feel appreciated, a salary sacrifice car scheme is a fantastic opportunity to do this. Not only will they feel seen and heard, but they are likely to stay loyal if their needs are being met.

Cheaper company car tax

As mentioned previously, electric cars are well worth it over ICE cars. Not only because of the low maintenance and running costs but because you pay much less BIK rates than diesel and petrol cars.

Easy payments

If you’re thinking “is a salary sacrifice car lease worth it”, and you are someone who needs easy monthly payments without a credit check – then it’s really a no-brainer.

In this car scheme, monthly payments are fixed. That means stable payments and easy budgeting.

The scheme also includes servicing, maintenance and road tax. What a win-win-win!

Corporate discounts

In car schemes for salary sacrifice, the cars leased are on corporate discounts. Which means vehicles are available at a reduced cost.

This is beneficial for both the employee and employer.

When are salary sacrifice car schemes not worth it?

Now we’ve gone over when are salary sacrifice car schemes worth it, what about when salary sacrifice schemes are not worth doing?

Employee leaves

If an employee leaves during the contract, the payments of the company car will be left to the employer to pay. This includes any remaining costs of the car.

OSV offers a solution to this through Early Termination Insurance, which covers all unexpected surprises and costs. For more information get in touch with us today.

This goes both ways. If you are an employee with a company car, if you leave your job you have to hand back the car to the company. So, this is worth keeping in mind.

Pension contributions

Although you do benefit from paying less tax, you could also be paying less into your pension contributions when taking part in a car scheme.

ICE car

If you are really against electric cars and are looking to get a traditional internal combustion engine vehicle, such as a petrol or diesel car, then a salary sacrifice car scheme won’t be the best solution for you. There are much better alternatives for diesel and petrolheads, such as leasing or financing.

You want to own the car

In salary sacrifice car schemes, the company car is financed on a lease agreement so the vehicle is the property of the lease company which has an agreement with your employer.

At the end of the agreed contract on the vehicle, you will hand this back and have the opportunity to choose a new vehicle via the salary sacrifice scheme again.

Lower-income

If you are on a lower income close to the national minimum wage, taking part in the scheme could be less beneficial for you financially, as it could take you below the national minimum wage threshold.

Whether or not you are okay with this, an employer cannot allow employees who risk going below the threshold to take part in a salary sacrifice car scheme.

Restricted mileage

If your commute often varies, and you don’t have a set average number of miles you drive per year, it’s likely this scheme won’t be suited for you. As you must stick to a set number of miles per year, usually from 5,000 to 10,000 miles.

This isn’t set in stone, as you can pay more monthly if you go over the pre-agreed annual mileage. However, if your life is unpredictable and you aren’t sure how much driving you will be doing, it is likely getting a car through this scheme will not be ideal for you.

Are salary sacrifice car schemes worth it?

So, now that we’ve explored the question – Are salary sacrifice schemes worth it? – and gone over when you should and shouldn’t take part in the scheme, let’s reflect on what we’ve covered so you have a final answer.

If you are an employee looking to go electric, enjoy financial benefits including paying less tax, BIK rates, and NI contributions, and wouldn’t mind sacrificing a portion of your salary to get a brand-new EV for less – then a salary sacrifice car scheme will be well worth it.

If you are an employer looking to increase employee retention, engagement and loyalty, looking to recruit new talent, and building your company’s green credentials – would salary sacrifice car schemes be worth looking into? Definitely.

If, however, you are someone who wants to own a car at the end of the agreement – whether that be petrol or diesel, and are on a lower income, or are looking to apply for a mortgage – it may be that a salary sacrifice car scheme is just not worth it – yet.

10 reasons your work must offer Salary Sacrifice on EVs

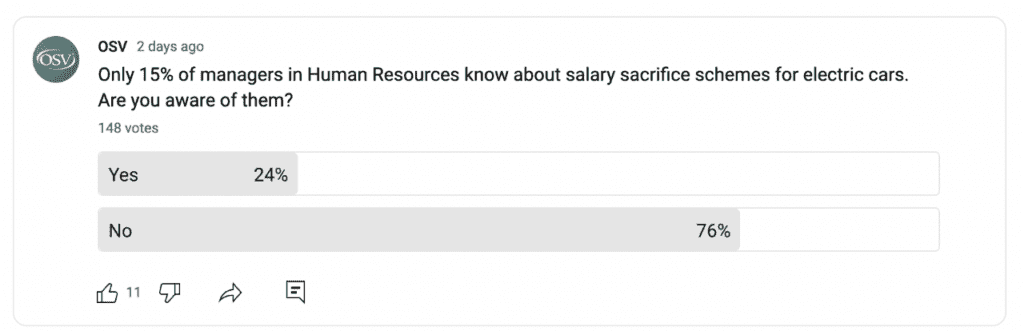

Did you know that just 15% of managers in Human Resources departments are aware of salary sacrifice schemes for cars, especially electric?

OSV took to its YouTube following of 78.6K and ran a poll asking if they were aware of salary sacrifice schemes on electric cars. Here are the results:

Not too far from the original findings, a whopping 76% were not aware of salary sacrifice schemes for electric cars.

Considering the vast benefits up for grabs for both employers and employees, it’s a real shame only 24% are aware of these.

So, why should your workplace care about salary sacrifice schemes for electric cars?

1. Employee appreciation

How does this benefit the employee?

Being appreciated at work is always welcome, and whilst employees may be appreciated by their employers – they may not think or feel it.

Offering an opportunity to get a car that perhaps employees couldn’t afford otherwise, as well as a bundle of financial benefits is a great way to ensure employees feel taken care of.

Why should the employer care?

Appreciation goes a long way. As some say, what goes around comes around.

An employee who feels valued and respected as a person is much more likely to return the favour.

Companies that fail to appreciate their employees risk facing demotivation among staff.

A whopping 43% of employees are demotivated due to feeling invisible or undervalued.

Which side of the scale do you want to be on?

2. Reduced National Insurance

How does this benefit the employee?

When an employee takes part in a salary sacrifice scheme, they are reducing their salary in return for a benefit, such as childcare support or a new electric car.

As the salary is reduced before tax deductions, the employee pays less national insurance (NI).

How?

Employees pay a percentage of their salary towards NI. This is usually 12% of their earnings.

If, for example, their monthly wage is £2,625. The employee would usually pay £315 NI per month.

When they take part in a salary sacrifice scheme, let’s say it reduces their monthly wage by £300, they would then only pay £279 of NI per month.

Why should the employer care?

Employers also get to enjoy NI reductions. As many may already know, employers pay 13% of NI contributions for each employee.

As explained previously, if the employee’s salary is reduced so are their NI contributions. This applies also to the amount the employer pays too.

So, both parties get to enjoy money-saving benefits!

3. Reduced tax

How does this benefit the employee?

On top of reduced NI contributions, employees also pay less tax.

How does this work?