Vehicle Excise Duty or VED is more commonly referred to as Road Tax. It’s a tax levied by the UK Government to drivers and motorcyclists (though the latter pay at a different rate than is mentioned in this article) and brings in an estimated £730 million every year in revenue.

The tax is collected by the Driver and Vehicle Licensing Agency (DVLA), a government department that keeps records of all drivers and vehicles on UK roads.

However, funds from Vehicle Excise Duty are not reserved for the upkeep of Britain’s roads, this is now covered by payments from Council Tax and general taxation.

History of Vehicle Excise Duty

Vehicle Tax was first introduced to road users in the UK in 1888, however, this was not a tax specifically for drivers of motor vehicles, that particular tax wasn’t created until 32 years later, in 1920. This tax was paid into the Road Fund, which was used solely for the construction and maintenance of the road system.

In 1937, the Government ended the payment of Vehicle Tax into the Road Fund, instead paying the revenue into the Consolidated Fund, which is where all funds from general taxation (including income tax, corporation tax and fuel duty) go. This means that the funds paid through Vehicle Excise Duty are no longer reserved solely for the purpose of repairing or constructing roads across the UK.

When did vehicle tax change?

In April 2017, big changes happened to the Vehicle Excise Duty system. The system that had been running up until this point had been introduced in 2001 and worked on vehicle emissions in the hope of reducing the desire for cars that had higher pollution levels.

This premise remained the same for cars already on the road when changes happened in April. However, new cars purchased after April 2017 are subject to the new VED costs. There is a first-year rate now that sees some higher polluting cars incurring a charge of just over £2,000. Only zero-emission (all-electric or hydrogen fuel-cell) cars are exempt.

Vehicles with a list price of more than £40,000 are also subject to a further cost added to their Vehicle Excise Duty, vehicles with 0% emissions are not exempt from this expense.

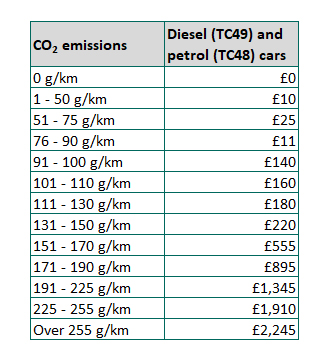

What are the first-year VED charges?

The first-year charges for your car depend greatly on the vehicle you drive. The difference in first-year costs between driving a Nissan Leaf or a Porsche 911 is vast due to their very different CO2 emissions.

In the table below you’ll see just how much a higher polluting car is going to cost in the first year payment alone. If you’re buying or leasing a new car then you’ll need to know these first-year rates. The impact they have on overall running costs are substantial and being aware of them in advance will help you to budget better.

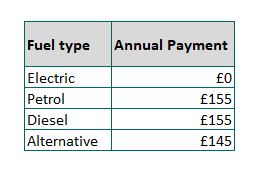

How much VED will I have to pay after the first year?

Once you’ve made your first-year payment all cars go onto a standard rate. The rate you will pay depends on your vehicle’s fuel type.

LOOKING FOR A NEW CAR?

Do you have any questions you want answered about cars with lower Road Tax?

Let us help you…

Vehicle Excise Duty for older vehicles

If you drive a car that was registered on or before 1 March 2001 then you will continue to pay VED at the rate you have been accustomed to. This rate is calculated based upon cubic centimetres meaning that engines smaller than 1549cc or approx 1.5 litres must pay £160 per year if they pay for 12 months up-front.

Older cars with larger engines are required to pay £265 per year.

On this scheme of VED you are incentivised to pay upfront to get the better deal. If you elect to pay in 6-month instalments then the price may vary slightly. If you would like to find out the full breakdown of the charges they are available and regularly updated on the DVLA website.

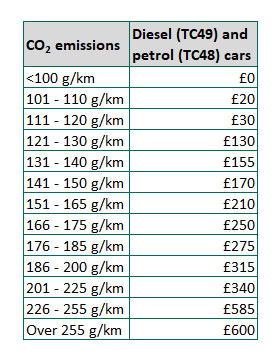

Vehicle Excise Duty for newer vehicles

We’ve already given you the low down on brand new cars, but if your car was purchased new after 1 March 2001 then your VED rate is calculated differently.

For newer cars, it’s all about how much CO2 your car emits; the higher the g/km, the higher the amount you’ll pay.

Petrol and diesel cars are the most common vehicles taxed. The VED calculation is broken down into bands and the cars are categorised into these bands based upon their CO2 emissions.

The prices below are based upon paying for 12 months VED up-front for diesel, petrol and alternative fuel cars. However, there are other payment options, including paying over 12 months by Direct Debit and the amount payable for these options will differ.

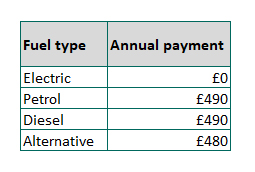

Are there any other costs?

As we’ve previously mentioned, if your vehicle has a list price (the published price of your car before any discounts) of more than £40,000 there will be an additional sum added to your annual VED payment. This rate is only payable from the second time the vehicle is taxed and only for the first 5 years you have the car.

In the table below we have highlighted the cost if you were to make the full payment in one go, though there are other options should you wish to spread the payments out across the year.

*As of 1 April 2020, all 100% electric vehicles with a list price of over £40,000 are exempt from paying the additional Luxury Vehicle Tax.

How do I pay Vehicle Excise Duty?

Paying your VED can be done in a variety of ways. The quickest and easiest solution is to pay online by debit or credit card. When making an online payment you will need at least one of these documents to hand.

The car’s V5C registration document or the V5C/2 new keeper supplement if you’ve only just bought the car.

The V11 reminder letter or your last-chance warning letter from the DVLA.

Alternatively, you can pay over the phone by calling 0300 123 4321. This call is charged at your local rate.

It’s also possible to pay at the Post Office. If you choose this option, you’ll also need to bring some documentation with you.

You will need to bring one of the following documents:

- Your V11 reminder letter

- Your last-chance warning letter from the DVLA

- V5C registration document

- V5C/2 new keeper supplement

You will also need to provide your:

- MOT test certificate valid for the start of the new tax period

- Valid Reduced Pollution Certificate (if your vehicle has been modified to cut emissions).

Note: In Northern Ireland, you’ll need to bring your insurance certificate or cover note.

What vehicles are exempt from paying Vehicle Excise Duty?

Not all vehicles on the road are required to pay vehicle excise duty. Here’s the complete list of all vehicles exempt from paying vehicle tax.

- Any vehicle used by a disabled person (find out more about Motability)

- Any vehicle more than 40-years-old on January 1st

- Electric vehicles

- Steam vehicles

- Mobility scooters

- Ride-on lawnmowers

- Agricultural, horticultural and farming vehicles

It’s important to remember that even if you don’t have to pay any Vehicle Excise Duty you will still need to register your vehicle.

What does it mean if a car is SORN?

You can own a car that is not driven on public roads and in this case you are also exempt from paying Vehicle Excise Duty. You must, however, declare it to the DVLA. This declaration is known as a Statutory Off-Road Notification or SORN. If you don’t declare your off-road vehicle as SORN then you will be liable for paying VED on it.

What else do I need to know about Vehicle Excise Duty?

You no longer receive a tax disc to display in your car windscreen once you’ve paid your VED. This was abolished in October 2014 as part of a drive to save money. It’s certainly a greener approach and means you don’t have to wait for a tax disc to arrive in the post to display in the corner of your windscreen. However, the long-term benefits to this change have yet to be discovered.

Another important change is that you can no longer buy a car pre-taxed. Previously, some second-hand car dealers would include 6 months’ tax on a car as a buyer incentive to help close the deal. It was also possible to sell a car with VED if you were selling it mid-way through the valid tax period. However, in 2014 this also changed, new owners must tax the vehicle themselves before they can drive it.