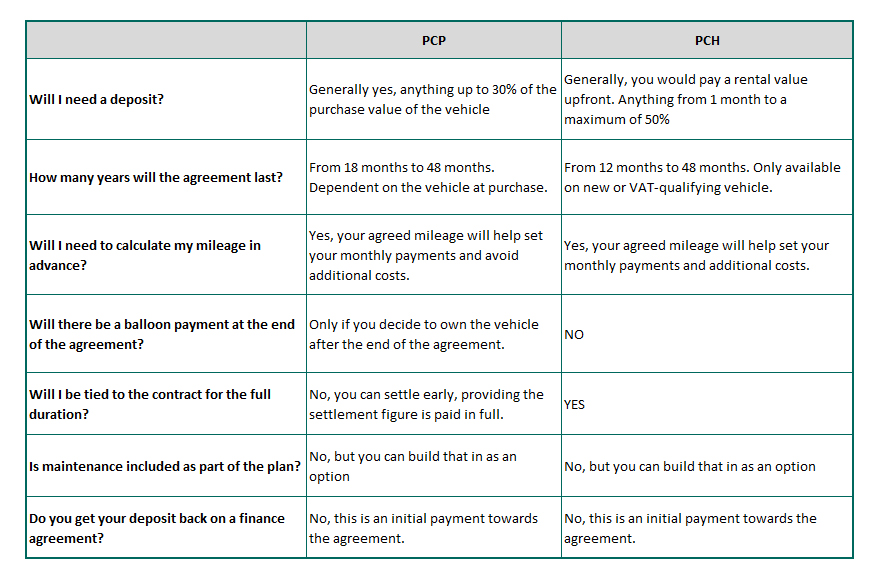

When it comes to choosing a new vehicle there are quite a few important decisions to make, however, the biggest concern is the sort of finance agreement you are going to settle on.

A question that we often get asked is about the difference between Personal Contract Purchase and Personal Contract Hire. This is understandable as they are quite similar. However, there are some key differences that could be the decider when you are looking at which of the two agreements is best for you and your circumstances.

So, in this article, we’ll be looking at what Personal Contract Purchase is, what Personal Contract Hire is, and the main differences between the two.

What is Personal Contract Purchase?

Also referred to as PCP, Personal Contract Purchase is an agreement designed for private individuals. It offers more flexibility than other agreements available.

In a PCP agreement, you make fixed monthly payments over the period of the contract, which is usually between 2 and 4 years. At the end of the contract, you have three options:

- You can hand the vehicle back (subject to mileage and condition restrictions)

- You can buy the car or van for a pre-agreed value also known as the Guaranteed Minimum Future Value (GMFV)

- Or, you can part-exchange the vehicle. Once the finance has been cleared, you can use any equity to go towards the deposit of your next vehicle.

What is Personal Contract Hire?

You will often see Personal Contract Hire referred to as PCH, but what exactly is it?

PCH is a very popular type of car hire agreement. In fact, over 70% of our custom is for Personal Contract Hire.

Essentially, a Personal Contract Hire agreement allows you to have your car for a set period, between 2 and 5 years. For the duration of the agreement, you pay a set monthly fee. Once the agreement period is over, you hand the car back with nothing else to pay (as long as you stick within the conditions of the agreement, of course).

Have questions about the other finance options available? Download our FREE guide for all the answers.

What is the difference between Personal Contract Purchase and Personal Contract Hire?

The main difference between the two is that with a Personal Contract Hire agreement, you don’t own the car or van at the end of the agreement.

If you decide to get your vehicle using a Personal Contract Purchase agreement you have the option to own the vehicle at the end of the contract.

What are the pros and cons of Personal Contract Purchase?

Before you decide which option is best for you, it’s best to weigh up the pros and cons of each agreement type.

So, what are the advantages of Personal Contract Purchase?

- Flexibility

- This is probably the most attractive thing about Personal Contract Purchase.

- The contract is much more flexible than other agreements. You also don’t have to decide what you want to do straight away. You tend to have about a month before the agreement ends before you decide what you want to do with your vehicle

- You agree the end payment at the beginning of your contract

- If you choose to buy your car, you will be paying the Guaranteed Minimum Future Value. This is how much the finance house expects the car to be worth at the end of the contract

- As the costs are decided at the beginning of the agreement you know how much your vehicle will be should you wish to purchase it, therefore you can budget accordingly

- You can hand the vehicle back

- If you don’t want to buy the car or van, you can just hand it back. So long as you keep within the mileage and condition restrictions, but more on that in a bit.

However, there are also some disadvantages to Personal Contract Purchase. For example:

- If you want to hand the vehicle back and it’s within the agreed mileage and kept in good condition then there’s nothing more you need to do

- However, if you have gone over the agreed mileage then you will need to pay an excess mileage fee. This can be anything from 1p to £1 per mile. You can read about excess mileage charges here

- If you hand your car or van back and it is damaged, you will be charged for the repair

- Personal Contract Purchase tends to be more expensive than Personal Contract Hire

- The interest rate tends to be higher than if you were to get a Hire Purchase

- You are responsible for taxing the vehicle

- When you lease, the tax is included, but it isn’t with a Personal Contract Purchase.

- It may affect your credit score

- The full cost of the vehicle is shown on your credit file.

What are the pros and cons of Personal Contract Hire?

We’ve looked at the pros and cons of Personal Contract Purchase, now what are the advantages and disadvantages of Personal Contract Hire?

Some of the advantages of this type of agreement are:

- You don’t have to worry about depreciation

- Because you aren’t having to dispose of the vehicle yourself, depreciation is not something you will have to worry about.

- There’s no risk of negative equity

- Again, because you aren’t responsible for the disposal of the car.

- You can get a nicer vehicle for less money

- Monthly payments on personal contract hire are significantly cheaper than personal contract purchase. As you are paying for the depreciation, it’s possible an Audi will have the same monthly payments as a Peugeot. We have written an article all about how to get the best lease deal to fit your requirements.

- They are also fixed payments, which makes for easier budgeting.

- Road tax is included

- Unlike Personal Contract Purchase, road tax is included in the contract. This is again, because you don’t own the car and therefore are not liable to keep it taxed.

But, there are disadvantages to Personal Contract Hire, these include:

- You don’t own the vehicle

- This is subjective. Some people see this as an advantage and some do not. If you want the option to own your car or van at the end of the contract, then Personal Contract Hire is not for you

- You are subject to mileage and condition restrictions

- When you have a contract hire car, you have to keep within a pre-agreed mileage. If you go over this, then you will incur excess mileage charges

- You also have to keep the car in good condition. We’re sure that you will, however, you will need to keep it up to the BVRLA Fair Wear and Tear standard. You will receive a guide when your vehicle is delivered. If, when you return the vehicle it doesn’t meet this standard then you will likely incur extra charges for repair.

Looking for a new vehicle and want to talk to someone about your options? Get in touch with our team of vehicle experts and we can help. Call us now on 01903 538835, or request a callback.

Personal Contract Purchase versus Personal Contract Hire

Personal Contract Purchase or Personal Contract Hire – which will get me the best deal?

So, you’ve weighed up the pros and cons and now you want to know which one will get you the best deal.

In reality, it depends on your individual situation. There are so many things that can affect how much each contract will cost, so you will need to speak with the experts.

It also depends greatly on what you would personally define as a good deal. For example, Personal Contract Hire may get you the best deal because you want a nicer car for less money. Alternatively, you might find a great deal on a car on Personal Contract Purchase that you plan on buying at the end of the contract. It’s all down to your situation and what you need from the agreement.

Of course, if you go through a reputable broker with access to a large network of Finance Houses and manufacturers, you’ll be able to get a great deal whatever agreement you decide on.

Hopefully, this article has informed you of the differences between Personal Contract Purchase and Personal Contract Hire, and shed some light on which contract is best for you. While there are similarities between the two, they do have some very clear differences and it’s important that you think about these carefully before making a decision. If you are in doubt, speak to one of our Vehicle Specialists.

Hello,

I’ll be moving to the UK on 14 July from Japan. I’ll be working at RAF Lakenheath. I am very interested in a pick-up truck/double cab. My spouse is interested in a Mini/Countryman.

We are looking at the Personal Contract Hire option which is similar to the lease program in the US.

The phone number is to my cousin in the UK. I’ll have a new number as soon as I arrive. Any information would be greatly appreciated.

Can you assist us please?

Thanks,

David

[email protected]

Hi David,

Your enquiry has been passed on to the team. Someone will be in touch with you directly.