Are you looking for a new van? If so, have you been considering van leasing and wondering whether this is the option for you?

There are many benefits to van leasing; you get a brand new vehicle, overall it tends to be cheaper than buying and you can upgrade every few years. It’s a valid option if you’re looking to get a new van.

When it comes to van leasing there are things that you need to consider and in this article, we take a look at the pros and cons, the lease contract options available and give you ideas of the type of vans available.

What are the best van leasing contracts?

When you’re looking for a new van there are a few lease contract options for you to choose from. The one that you eventually select will depend on your individual situation and what you need from the van including the mileage, how long you want the van for and what you want to do with it at the end of the agreement.

Finance Lease

If part of your business requires you to travel a lot of miles in your vehicle (upwards of 50,000) and it’s possible you’ll need to make modifications to the van, or it’s going to regularly be driven over rough terrain then it’s worth thinking about getting a Finance Lease.

There are many benefits to getting a van on a Finance Lease, especially if your business is VAT registered.

You can claim 100% of the VAT back on a Finance Lease in your annual VAT return (if you get a car you can claim 50% of the VAT back).

The cost of a Finance Lease is calculated using the overall cost of the vehicle, the duration of the contract (between 1 and 5 years if you get a van) and the amount you have agreed to make as the end payment (which is also known as the balloon payment).

The balloon payment is an estimate of what the value of the vehicle will be at the end of the agreement as mileage and condition won’t be available, it is based on how many miles you estimate you’ll do over the duration of the agreement and the wear and tear you anticipate it will have.

Even better, you can set the balloon payment, depending on how much you want to put down as your initial payment and the amount you’re willing to pay on a monthly basis.

When you reach the end of the agreement there are a few options you can take. You can:

- Continue to make monthly payments on a yearly contract (you will usually have a charge that is equivalent to one monthly payment in order to arrange this – this payment is often referred to as a Peppercorn rental)

- Return the vehicle

- The Finance House will then sell the vehicle to cover the balloon payment

- Sell the vehicle on to a third party to clear the balloon payment

- Any profit from the sale will be yours (minus a small administration fee)

- If the money from the sale doesn’t cover the balloon payment you will need to make up the difference

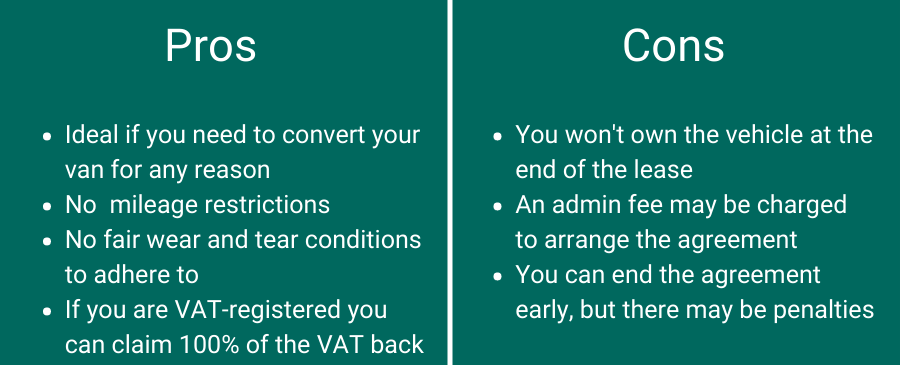

So, what are the advantages and disadvantages of a Finance Lease?

There are a considerable number of advantages to a Finance Lease for a business, especially if you’re looking for a vehicle or multiple vehicles.

If you’re looking to convert your van – perhaps you need one to transport food requiring refrigeration, or a vehicle for transporting a number of dogs – Finance Leases give you this flexibility. There is no annual mileage allowance and you don’t need to keep to the Fair Wear and Tear conditions outlined by the BVRLA.

You can end the agreement early, which could be seen as an advantage, though you may be asked to pay a sizeable penalty for this. You also won’t own the vehicle at the end of the agreement.

Contract Hire

The other option when it comes to van leasing is Contract Hire. This is actually the most popular and traditional lease agreement available. It’s a perfect option if you’re looking to simply hand the van back to the Finance House at the end of the contract.

A business contract hire (or BCH) agreement enables a company to rent a van for between 1-5 years). Before you agree to the terms a mileage allowance is set and you will need to ensure the van is well maintained.

When you reach the end of the agreement you return the vehicle to the Finance House and you have nothing further to pay, subject to fair wear and tear and any excess mileage.

As with any finance agreement, there are pros and cons that we believe you need to know about.

Some of the pros are that:

- You won’t suffer any depreciation loss as you don’t have to sell the van

- As the monthly payments are consistent throughout it’s easy to budget for

- Vehicle Excise Duty (road tax) is included in the agreement

But with the pros come the cons, and these include:

- You will need to ensure the van is well-maintained as you’re subject to fair wear and tear conditions

- If you go over your mileage allowance you could incur excess mileage charges

- You won’t own the vehicle outright – though this could also be considered a positive.

What affects the price when van leasing?

When you start to look into van leasing it’s important to know what can affect the price of a van. It’s a relatively small list of items and incredibly similar to the things that can affect the price when you look at leasing a car. These things include:

- Mileage

- Length of the contract

- Type of van you’re leasing

- Residual value of the van

- Initial payment amount

With a Finance Lease, the price is also affected by the balloon payment at the end of the contract. As we’ve already said, due to the fact that you don’t have any mileage or condition restrictions with a Finance Lease there is no way to truly tell how much the van will be worth at the end of the agreement. The balloon payment is one estimated on how many miles the van may do and the condition it will be in at the end of your lease.

What should I consider when looking at van leasing?

So, what sort of things should you be looking for when you’re thinking about van leasing? We always suggest that you put together a list and below are a few of the things that you consider when you start your search:

- Type of contract best suited to your situation

- Size of the van

- Mileage

- Initial payment amount

- What the van will be used for

- Payload and loadspace

- Running costs

All of these things will come into play when you start to consider the best van to lease for your business. There are so many different vans available and each of them has something different to offer when it comes to your business needs. We’ve put together some articles that will give you some guidance on the type of vans available depending on your business, these may help when you start your search.

- Gardening vans

- Work vans (scaffolding, construction, carpentry)

- Refrigerated vans

- Vans for dog walkers

Conclusion: What are the next steps?

As you can see from the article, there are a few things to consider when you’re looking to lease a new van, including putting together a list of your business requirements, such as the sort of work you’re going to be doing, which will lead to decisions on payload, range and load space. You’re also going to need to think about your budget, mileage and how long you want to keep the van for. Once you’ve put together all of this, the next step is to speak to someone and that’s where we come in.

At OSV we have over 20 years of experience helping people like you to find the right van for your business. Whether you’re looking for a fleet or a single van, give our experienced team a call and let us help you to find the right vehicle to fit all your business needs.